Australian lithium miner Liontown Resources Ltd. said it is willing to back a new A$6.6 billion ($4.3 billion) takeover offer from Albemarle Corp., the world’s top producer of the battery metal.

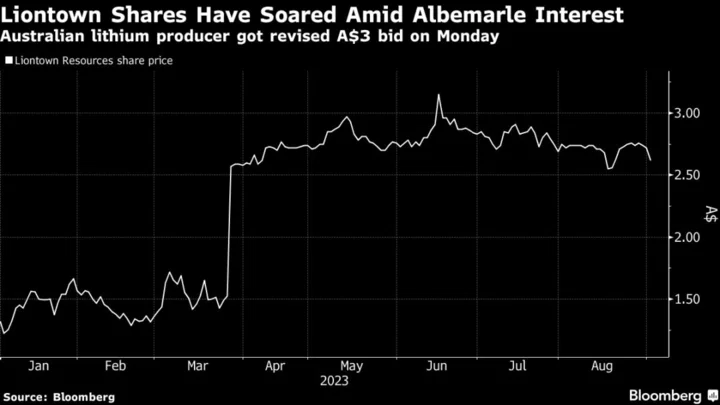

The US-based producer boosted its per-share cash offer to A$3, Liontown said Monday, up from A$2.50 per share in March. The Western Australia-based target said it was willing to recommend the latest bid — a 15% premium to Friday’s close — and granted the firm due diligence.

Such a deal would cement the stunning rise of the Australian lithium sector, where newly founded and previously little-known companies have soared more than tenfold. It reflects surging demand for the metal from carmakers amid a transition away from fossil fuels.

The offer comes after a slump in lithium prices from last year’s record and a corresponding drop in share prices of lithium producers. Albemarle, which already owns stakes in lithium mines in Australia and has a processing plant, had offered to acquire all of Liontown’s equity at A$2.50 a share, its third bid in five months, the Perth-based company said in March.

Read more: Lithium Craze Sparks 1,100% Stock Gains as Well as Deep Losses

Liontown had previously rebuffed Albemarle’s approach on the basis of forecasts for fivefold growth in global lithium demand by 2030 and a predicted supply deficit.

The company owns one of the most promising early-stage lithium projects in Australia, the world’s top exporter of the battery metal, and has supply agreements with major automakers including Tesla Inc. and Ford Motor Co.

(Updates with Liontown’s conditional acceptance of offer from first paragraph)