Arini, the hedge fund founded by former Credit Suisse debt trader Hamza Lemssouguer, is among the largest bondholders in a unit of struggling property firm Signa Holding GmbH, according to people familiar with the matter.

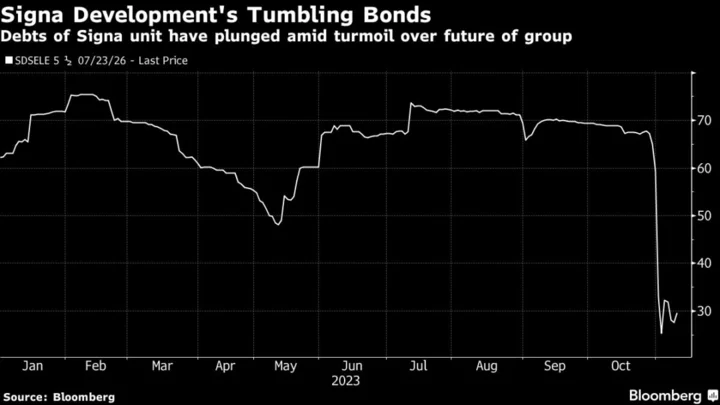

Lemssouguer’s fund is part of a group that holds about €150 million ($160 million) of bonds tied to Signa Development, said the people, who asked not to be identified because the details are private. The bonds have plunged as concerns mount over the future of Signa Holding, which co-owns New York’s Chrysler Building.

After two decades of aggressive expansion under controlling shareholder Rene Benko, rising interest rates and plunging valuations have battered Signa’s finances. On Wednesday, the company replaced Benko as chairman of its advisory board with a restructuring specialist in a last-ditch effort to save the real estate empire.

A spokesperson for Arini declined to comment, and a representative for Signa didn’t immediately reply to a call seeking comment.

While Arini added many of the bond positions at prices well below par, the people said, the recent plunge could put a dent in what has been a strong year. Arini’s Credit Master Fund, which oversees about $2.4 billion, gained 21% this year through October, according to a document seen by Bloomberg. A rough comparison of peers in the Eurekahedge Structured Credit Hedge Fund Index shows a gain of about 7% this year.

S&P Global Ratings cut Signa Development’s credit rating to CCC from B- on Thursday and assigned a negative outlook. The ratings firm cited the risk that the company could potentially default over the next 12 months because of a liquidity shortfall.

Signa Development’s 5.5% bonds have tumbled amid the turmoil. The notes were quoted at about 29 cents on the euro at 9:35 a.m. in London, down from almost 70 cents last month, according to bond price data compiled by Bloomberg.

Lemssouguer specialized in large bets on high-risk European debt while at Credit Suisse before leaving in 2021 and setting up his own fund with backing from Squarepoint Capital. In a recent interview, he spoke of the increasing stresses in the Continent’s credit markets as an era of easy money comes to an end.

Read More: Lemssouguer’s Next Trade Is Fast Cash for Stressed Credits

“Maybe this market is something we have never seen before,” Lemssouguer said. “There is a lot of stress and distress and a maturity wall.”

--With assistance from Nishant Kumar and Marton Eder.

(Updates with bond price in the seventh paragraph. An earlier version of this story corrected the characterization of the fund’s bond ownership in the first deck headline.)

Author: Laura Benitez, Donal Griffin and Giulia Morpurgo