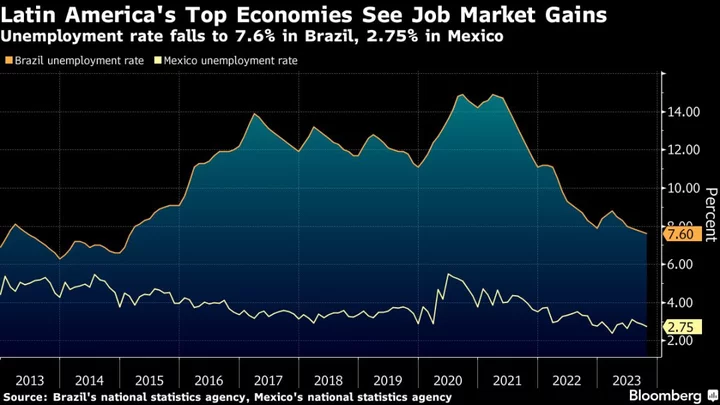

Unemployment rates in Brazil and Mexico fell in October, as strong labor markets underpin the outperformance of Latin America’s largest economies in the face of high interest rates.

Official data released Thursday showed Brazil’s unemployment rate declined to 7.6% from a month earlier, with the number of out-of-work people falling to 8.3 million — both figures the lowest since 2015. In Mexico, the jobless rate dropped to 2.75% in the same period.

Robust job markets are helping to propel growth well above estimates from the start of the year. In Brazil, bumper harvests led to gains and have helped drive the unemployment rate lower for seven straight months. Meanwhile, the region’s second-largest economy has benefited from a flood of foreign capital for investments serving North American markets and also strong domestic demand.

Read more: Hot Job Markets Spur Brazil, Mexico Economies Against All Odds

In Brazil, the total number of employed people breached 100 million for the first time on record. Still, some 20 million workers remain underutilized, according to the national statistics agency.

What Bloomberg Economics Says

“Brazil’s October labor report supports the central bank’s current monetary policy strategy — becoming gradually less contractionary via 50-basis-point rate cuts per meeting. The labor market remains tight, but is cooling at the margin and that leaves some room for the Brazil Central Bank to continue easing. A further increase in labor income advises against accelerating the pace of rate cuts.”

—Adriana Dupita, Brazil and Argentina economist

—Click here for full report

Mexico’s number of employed people hit 59.4 million, representing a rise of one million from the same month a year prior, according to the government report.

Formal employment rose 0.1% on the month in seasonally-adjusted terms and a “solid” 3.2% year-on-year, according to Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc. “A tight labor market is one of the factors supporting a conservative calibration of monetary policy,” he wrote in a report.

Outshine

More disposable income and rising wages have buttressed consumer confidence in both nations. In turn, improved sentiment has driven stronger demand of goods and services, allowing Mexico and Brazil to outshine other important regional economies including Chile, Colombia and Argentina.

Mexico’s central bank, known as Banxico, on Wednesday raised its 2023 and 2024 economic growth forecasts to 3.3% and 3%, respectively. The economy is benefiting from “a resilient external demand and domestic spending dynamism,” Banxico Governor Victoria Rodriguez Ceja told reporters.

She added that lowering the interest rate from the current level of 11.25% in early 2024 was a possibility to be discussed with other board members.

Last week, Felipe Garcia Ascencio, chief executive officer of Banco Santander SA’s Mexico unit, said in an interview that greater investments in the local economy mean domestic employment is going to remain healthy.

Brazilian policymakers led by Roberto Campos Neto see the domestic job market as “rather dynamic” with a high level of hiring, according to the minutes of their November monetary policy meeting. At the same time, they have reiterated that the economy will slow during coming quarters.

Brazil has room to continue lowering borrowing costs from the current level of 12.25%, Campos Neto said in an interview last week. Policymakers have already delivered three straight half-point reductions.

--With assistance from Giovanna Serafim and Rafael Gayol.

(Updates with release details and economist quotes starting in fourth paragraph)