Bankrupt FTX Trading Ltd.’s latest lawsuit against co-founder Sam Bankman-Fried and his former top executives revealed new details about the allegations of massive fraud at the fallen crypto conglomerate.

The complaint Thursday showed FTX Trading is seeking to claw back millions of dollars in cash and unwind over $1 billion in questionable transactions.

Read more: FTX Sues Bankman-Fried, Associates Over $1 Billion in Bad Deals

The lawsuit revealed Caroline Ellison, former co-chief executive officer at affiliated hedge fund Alameda Research, estimated a more than $10 billion cash deficit at FTX.com about eight months before the crypto exchange fell apart.

The document also claims that Bankman-Fried and former FTX Chief Technology Officer Gary Wang took $546 million from Alameda in May 2022 to acquire shares in Robinhood Markets Inc.

Here are some other accusations in the complaint:

Private Island

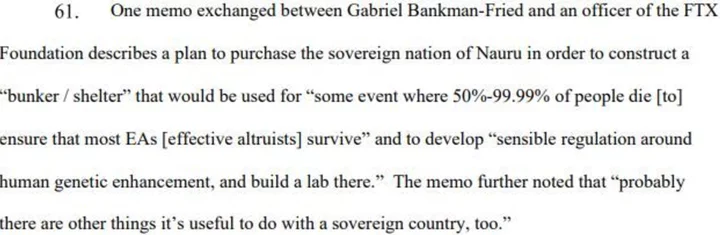

The lawsuit said the FTX Foundation — FTX’s nonprofit arm — pursued projects that were “frequently misguided and sometimes dystopian.” It alleged that a memo exchanged between a foundation officer and Bankman-Fried’s brother, Gabriel Bankman-Fried, laid out a plan to purchase the tiny island nation of Nauru and build a bunker there.

In the event that half or more of the global population perished, the island would then be used to ensure the survival of members of the effective altruism movement — a philosophy that Sam Bankman-Fried publicly ascribed to. The memo noted that “probably there are other things it’s useful to do with a sovereign country, too,” according to the complaint.

Big Bonuses

Ellison gave herself a $22.5 million bonus around the time in March 2022 when she estimated a more than $10 billion cash shortfall at FTX.com, according to the lawsuit. Through a series of convoluted transfers, Ellison allegedly deposited the money from Alameda into her FTX account, with $10 million of the funds making their way to her personal bank account.

She used the money for a $10 million investment in an artificial intelligence company in her own name. On different occasions in 2021 and 2022, Ellison also allegedly misappropriated funds to give herself a multimillion-dollar bonus. The complaint noted that “no ‘bonus’ could possibly be justified given Ellison’s extensive misconduct.”

Back-Scratching

Much has been made of Sam Bankman-Fried’s inner circle and their special privileges. The complaint lays out how executives benefited from their claimed abuses of power.

On one occasion, Nishad Singh, FTX’s former director of engineering, allegedly received a fraudulent transfer of about $477 million worth of FTX common shares without having to pay anything in return. Sam Bankman-Fried allegedly granted himself rights to more than $6 million in equity without paying anything in return in February 2020. Ellison also allegedly received 2.75 million valuable FTX call options without providing anything in return between December 2020 and March 2021.

Going Public

Sam Bankman-Fried had expressed ambitions of taking FTX public on multiple occasions. The complaint alleges that he was taking steps, albeit fraudulent ones, to make his goal a reality.

The lawsuit claims that in April 2021, he signed a sham “Payment Agent Agreement” that was falsely backdated by nearly two years. The agreement had been readied for an external auditor, who was supposed to prepare a financial statement of FTX as the firm considered an initial public offering.

Ellison, Wang and Singh have admitted to fraud and are cooperating with federal prosecutors. Sam Bankman-Fried has rejected an array of charges and faces a trial in October.

A representative for Sam Bankman-Fried declined to comment on the latest lawsuit. Lawyers for Wang, Singh, Ellison and Gabriel Bankman-Fried didn’t immediately respond to messages sent after normal business hours seeking comment on the complaint.

The case is FTX Trading Ltd., 22-11068, US Bankruptcy Court, District of Delaware