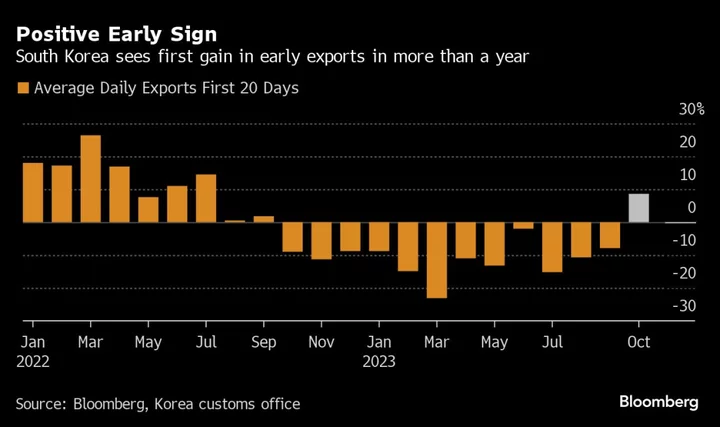

South Korea’s early exports returned to growth for the first time in more than a year in another indication of recovering external demand that will offer some reassurance to investors and policymakers monitoring the health of global commerce.

Daily average shipments for the first 20 days of October increased 8.6% from a year earlier in the first gain since September last year, according to data released Monday from the customs office.

The increase is a positive indication that world trade is starting to regain strength after a global slowdown. South Korea releases its data earlier than many economies and due to its key position in global supply chains and the tech sector, its export figures are watched closely to get an early take on the trajectory of world trade.

The gain is also an encouraging sign for South Korea’s economy, given its heavy dependence on external demand to drive growth.

Policymakers in Seoul have voiced hopes in recent months that full-month exports will return to year-on-year increases before the end of the year. That would support stronger economic growth if it materializes as suggested by October’s early data. The sales of semiconductors, the biggest cash cow for the country, have also shown signs of bouncing back, especially NAND flash memory.

“In the end, the rebound in chip prices is leading the exports rebound,” said Jeong Wonil, an economist at Yuanta Securities. “We may see an odd economic situation of high growth, high rates and high inflation next year.”

In a separate report Monday, the Bank of Korea highlighted the recovery in semiconductor demand and growing market optimism that it will continue to strengthen next year, citing the first increase in the price of dynamic random access memory in a year and a half last month. DRAM is the other type of memory chip for which Korea enjoys a dominant production role in global markets.

The BOK reiterated it would keep its focus on stabilizing inflation with tight policy.

Despite the preliminary gain in exports, risks remain for Korean trade. China continues to struggle to restore full momentum for its economy, which is the biggest destination for South Korean exports. The Israel-Hamas conflict is adding to other global uncertainties that may weigh on growth projections for trade-reliant nations like Korea.

The trade report showed that total headline exports, which do not account for working-day differences, rose 4.6% from a year earlier for the 20 days this month, while imports increased 0.6%. Exports to China fell 6.1%, for the smallest drop since summer last year, while those to the US increased 12.7%. Shipments to Japan rose 20% and those to Singapore jumped 37.5%, the data showed.

South Korea sold $5.2 billion in semiconductors over the first 20 days, 6.4% less than a year earlier. That’s smaller than the 14.4% decline for the full month of September, according to the data.

The trade deficit widened to $3.7 billion for the first 20 days, compared with a shortfall of $488 million in the same period last month, the customs office said.

(Updates with details and report from Bank of Korea)