South Korea is avoiding the global trend toward long-term agreements on liquefied natural gas due to high prices, a risky move that will leave the top importer exposed to the volatile spot market.

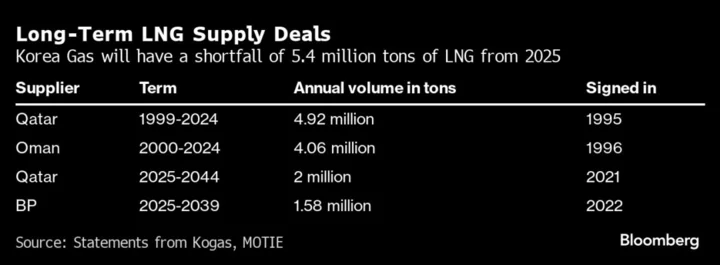

State-owned Korea Gas Corp. plans to rely on short-term deals or spot purchases to fill its supply needs, the energy ministry said. The company is facing a supply shortfall of almost 5.5 million tons beginning in 2025, after existing long-term contracts from Qatar and Oman expire, according to data from Kogas.

Russia’s invasion of Ukraine last year upended gas markets around the world, triggering record-high prices and stoking worries about fuel security. In contrast to Korea, neighboring Japan is urging its importers to lock in long-term deals to insulate itself from supply shocks, while rivals in Europe and Asia have signed several 27-year pacts with Qatar in recent months.

Long-term LNG purchase agreements insulate buyers from wild fluctuations in spot prices, but the contracts still tend to reflect the market sentiment of the day. For instance, 20-year LNG deals are currently being signed at about a 13% link to Brent oil. That’s much higher than in 2020, when similar agreements were done closer to 10% as the Covid pandemic triggered a supply glut.

Goldman Sachs analysts expect the next so-called bear cycle for LNG to begin in 2025, as new supplies from the US and elsewhere flood the market. The result could give Korea a better position when negotiating deals that span decades.

South Korea’s two biggest LNG supply agreements that were signed in the mid-1990s will expire next year, according to data compiled by Bloomberg. That represents 20% of the country’s annual consumption, according to the data.

Kogas has signed two long-term contracts with Qatar and BP Plc, which will be supplied from 2025 with a combined annual volume of 3.58 million tons, but the company will still be facing a shortfall.

The proliferation of private importers, including Posco Energy Co. and GS Energy Corp., also means that Kogas doesn’t need as many long-term LNG deals as it did a few decades ago, according to a spokesman from the company. It also expects LNG demand to decline as South Korea pursues clean energy goals.