A $5.4 billion rally in K-pop stocks looks set to power on, as a growing global fanbase fuels one of the hottest trades in South Korean equities.

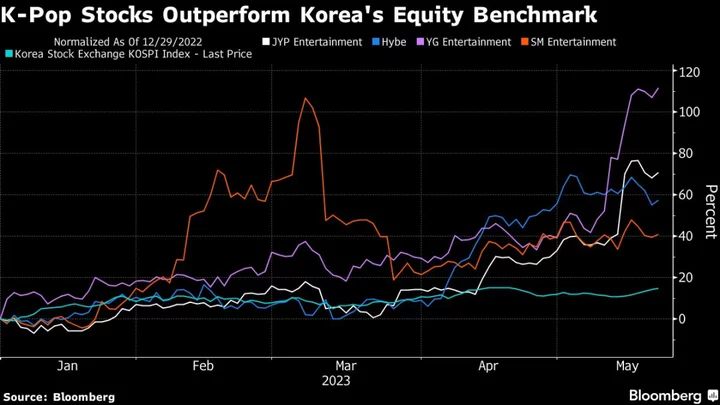

Shares of the nation’s four biggest K-pop agencies — Hybe Co., SM Entertainment Co., YG Entertainment Inc. and JYP Entertainment Corp. — have jumped at least 30% this year, double the advance in the benchmark Kospi Index. Overseas funds are snapping up the stocks as they outperform global recording labels including Universal Music Group NV and Warner Music Group Corp.

From BTS to Blackpink, the meteoric rise in South Korea’s pop groups has fired the imagination of equity investors in a market starved of trading ideas. Goldman Sachs Group Inc. and a slew of brokerages upgraded their price targets last month, making the sector one of the most popular bets alongside stocks linked to electric-vehicle batteries.

“There are half a dozen of new artists and groups that are popping up in the music market every week,” said Jangwon Lee, who created an exchange-traded fund tracking local entertainment shares. “It’s well on its way to become something that’s going to last longer. That’s why we are seeing the spikes in K-pop, Korean entertainment stocks.”

Among the biggest K-pop agencies, YG Entertainment has surged more than 100% this year and hit an all-time high this week. JYP Entertainment jumped 88% while SM Entertainment is up 33%.

Goldman raised its price target on JYP to 130,000 won ($98) from 97,000 won in May while maintaining its buy call. Similarly, several local brokerages upgraded Hybe, YG and SM after the firms reported first-quarter earnings, while Netflix pledged to invest $2.5 billion into Korean content over the next four years.

Sanford C Bernstein Ltd. listed Hybe as its top pick given the firm’s “advanced business structure,” with a target price that implies a 31% gain from the current level. The shares have rallied over 50% this year despite the company’s failed bid to take over smaller rival SM and worries about the outlook after its top act BTS took a career break.

The euphoria has spread far beyond South Korean shores. While global funds sold a net $1.2 billion of Kosdaq-listed shares this year, they purchased $477 million of three K-pop stocks. Kospi-listed Hybe drew a net $245 million of inflows, helping propel the benchmark gauge to the brink of a bull market.

Take Profit

But signs of stress are emerging amid all the hype.

Hybe tumbled as much as 5.1% Friday while SM Entertainment regained some ground after recording its biggest drop in two months the previous day. The losses were fueled by an announcement that members of one of its most popular bands had sought to end their exclusive contracts.

K-pop Giant Hybe Seeks to Raise Around $380 Million for US Deals

Valuations have also become more expensive after the recent rally: Hybe is trading at 45 times forward price-to-earnings ratio, nearly double from mid-October. JYP is trading at nearly 33 times, which is more than one-third higher when compared to the same timeframe. Universal Music, meanwhile, is trading near a seven-month low.

Still, die-hard fans are likely to remain undaunted, as they look to the resumption of live concerts and Beijing’s greater openness to foreign entertainment to drive growth.

With the world’s second-largest economy moving on from its pandemic-era days, K-pop fans will now be able to travel to meet their idols and purchase more albums, said Lee Hwajung, an analyst at NH Investment & Securities Co.

The sector “will record solid market growth trajectory at a compound annual growth rate of 12% in 2022-28 through a stronger presence in global market and monetization efforts of the K-pop producers,” Sanford C Bernstein analysts including Bokyung Suh wrote in a recent note.

Top Tech Stories

- Federal and state enforcers in the US “need to be vigilant early” as artificial intelligence develops to ensure businesses comply with existing laws and ensure the biggest companies don’t use their power to kill off promising innovations, Federal Trade Commission Chair Lina Khan said.

- Palantir Technologies Inc. Chief Executive Officer Alex Karp said new AI developments at his company are so powerful that “I’m not sure we should even sell this to some of our clients.”

- Broadcom Inc. predicted that sales tied to artificial intelligence will double this year, a sign it’s benefiting from the same frenzy that boosted Nvidia Corp., but the chipmaker remains mired in a broader slowdown.