In cryptocurrency markets, liquidity is uber-concentrated and has become more so over time, with nearly all of it found on just eight exchanges.

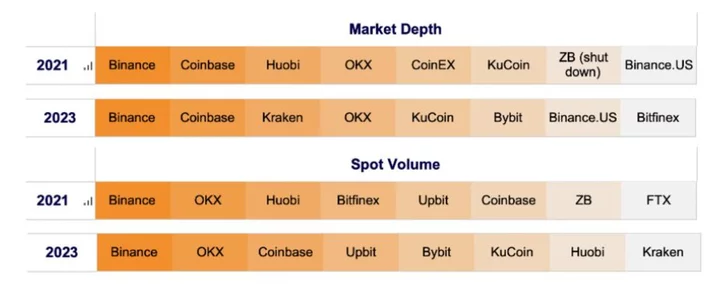

The top eight platforms account for nearly 92% of depth — a measure of all bids and asks within 10% of the mid price — and 90% of volume, according to Kaiko. Binance, the largest crypto exchange, has this year accounted for more than 30% of global market depth and more than 60% of worldwide trade volumes. Besides Binance, the list also includes Coinbase, OKX and Huobi, among others.

“Highly concentrated crypto markets are both a good and bad thing. There is undoubtedly a shortage of liquidity, which when spread thin across many exchanges and trading pairs can exacerbate volatility and disrupt the price discovery process,” wrote Kaiko’s Dessislava Aubert and Clara Medalie in a note.

“Natural market forces have inevitably led to increasing concentration of this liquidity on a handful of platforms, which benefits the average trader. However, highly-concentrated crypto markets can create points of failure for the industry (ex: the FTX collapse),” they added.

Hoards of investors who collectively lost billions of dollars fled the market following last year’s implosion in prices and the downfall of a number of previously standout firms within the industry. Many crypto analysts have been paying close attention to measures of liquidity and trading volumes. That’s because moves, one way or the other, can be exaggerated when trading volumes are thinner.

In August, crypto trading volumes declined to the lowest level of the year, another sign of waning investor interest and a surprising one given the slew of positive news that the industry has seen come out, including exuberance over a potential Bitcoin ETF. The combined monthly volume of so-called spot and derivatives trading fell 11.5% to $2.09 trillion, and was the second-lowest monthly total since October 2020, according to data compiled by CCData.

Read more: Crypto Trading Volume Dropped to Lowest for the Year in August

Volatility in crypto markets had remained subdued over the summer, with Bitcoin trading within a narrow range for months. However, the coin’s seven-day volatility this week hovered around three-month highs after it saw a couple of days of more outsize moves. Bitcoin on Friday traded little changed at around $25,800.

“The jumpy market over the last few weeks signals a changing volatility environment in BTC. This summer saw unusually low volatility, and while prices have yet to see any meaningful breakouts following the Aug. 17 push lower, climbing daily volatility reincentivizes participation from vol-thirsty day traders,” wrote K33’s Anders Helseth and Vetle Lunde in a note.

--With assistance from Olga Kharif.