Julius Baer Group Ltd. warned that its full-year profit will probably decline after provisions for bad loans jumped, sending the shares down the most in six months.

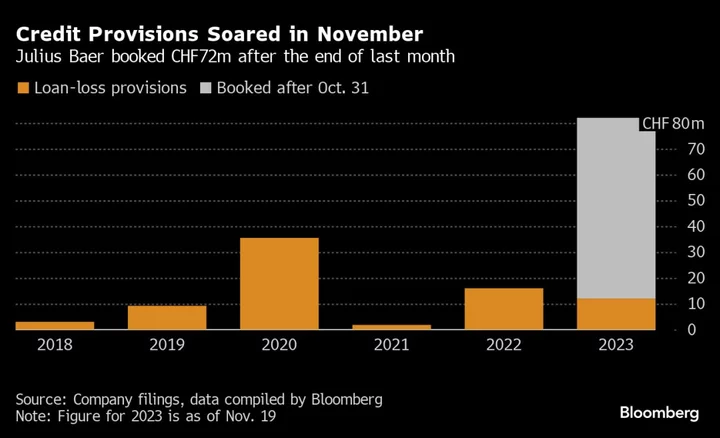

The Zurich-based bank has put aside 82 million francs ($93 million) for bad loans, of which 70 million francs were provisioned since the end of October, Julius Baer said on Monday. That and a higher effective tax rate will likely cause it to fall short of last year’s profit.

Julius Baer didn’t say what caused the increase in souring loans. The firm along with numerous other banks in Switzerland, Germany and Austria was a lender to the struggling property and retail empire of Austrian tycoon Rene Benko, people familiar with the matter have said. A spokesperson for Julius Baer declined to comment on the reason for the increase in provisions.

The jump in provisions “seems to confirm Signa exposure,” said Nicolas Payen, a Kepler Cheuvreux analyst, referring to Benko’s company.

The increase in provisions overshadowed more than 10 billion francs in net new money inflows in the first 10 months of the year, which helped push up assets under management to 435 billion francs. Switzerland’s second-largest wealth manager has benefited from the takeover of Credit Suisse by UBS Group AG. Julius Baer, which is led by Chief Executive Officer Philipp Rickenbacher, said it added a net 75 private bankers this year “with a promising pipeline supporting further hiring.”

The hires helped lift the cost-to-income ratio close to 68% for the first 10 months of the year, compared with 66% last year.

Julius Baer fell as much as 9.2%, the biggest drop since May. The decline erased all gains for the year, leaving the stock down about 5% since the start of 2023.

Rickenbacher last month reshuffled the executive board with a series of internal promotions and new hires from UBS, changes that position Chief Operating Officer Nic Dreckmann as potential successor to the CEO.

--With assistance from Allegra Catelli.

(Adds shares from first paragraph, analyst’s comment in fourth.)