JPMorgan Chase & Co. has ditched a bullish tactical view on Treasuries after a series of US economic data releases came in stronger than expected.

The bank’s fixed income strategists are unwinding their long position in five-year Treasuries as “we can no longer justify our tactical long duration view,” a team including Jay Barry wrote in a note to clients.

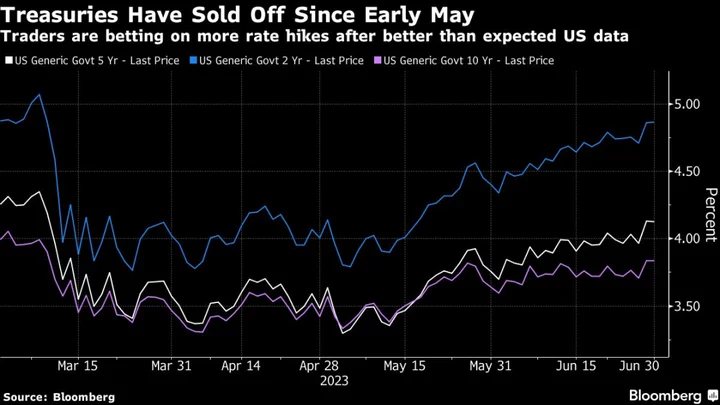

The shift came as robust US growth and labor data Thursday sparked a global bond selloff as traders bet the Federal Reserve will have to raise rates two more times this year. The yield on five-year notes has climbed more than 40 basis points this month to trade at its highest since March.

Global Yields Surge as Traders Favor Two More Fed Rate Hikes

“Treasuries have outperformed their underlying drivers, and valuations remain rich,” the strategists said. Investor “positioning is long, indicating there could be risks of long liquidation in the coming days.”

The selloff in Treasuries extended Friday with the yield on policy-sensitive two year notes rising three basis points to 4.89%, on track for a fourth consecutive week of gains. The yield on benchmark 10-year notes increased two basis points to 3.86%.

There is scope for the selloff to extend as the bond market wakes up to the stronger economic data and “wonders whether central bankers are right” that the economy is resilient, said Althea Spinozzi, a senior strategist at Saxo Bank AS in Copenhagen. If the market starts betting that way, shy away from 5-year yields, she said.

“There is scope for a soft landing — and as a consequence, the compression of long term yields is not justifiable,” she said. “The belly would be the first to react in case of change in sentiment. You’d want to be there only if the bias for a steepening becomes likely, but we are still far from that.”

(Updates with market move in fifth paragraph, Saxo view from second-to-last paragraph.)