Some of Wall Street’s top strategists are divided when it comes to Corporate America’s earnings outlook next year.

While Citigroup Inc.’s Scott Chronert expects profits to hold up even if the economy slips into a recession, JPMorgan Chase & Co. strategist Mislav Matejka says diminishing pricing power would crimp overall revenue and margins regardless of whether growth contracts.

Given that “the starting point of margins is elevated,” profit growth next year “could end up more flattish, rather than up, and this is without having recession as a base case,” Matejka wrote in a note. “If we have an outright contraction, then corporate profits are likely to fall.”

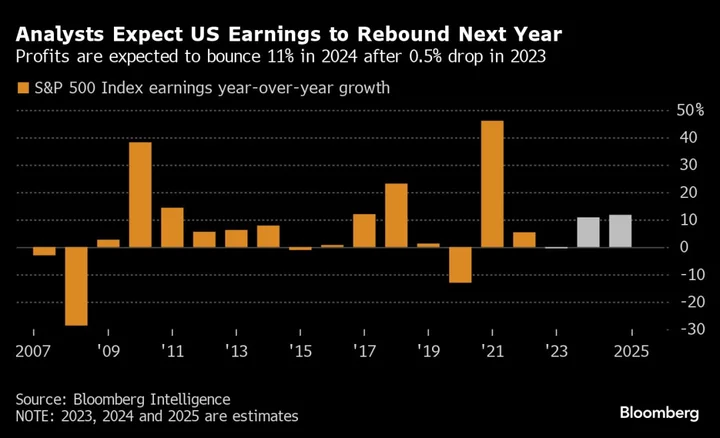

The pessimistic tone from Matejka — who has remained bearish on stocks this year despite an 18% rally in the S&P 500 — comes just as US companies are poised to see the end of an earnings recession one quarter earlier than expected. S&P 500 profits rose 4% in the third quarter, compared with analysts’ projections of a 1.2% decline, according to data compiled by Bloomberg Intelligence.

For 2024, analysts expect an 11% rebound in earnings after a 0.5% drop for full-year 2023, the data show. However, risks to economic growth are piling up at a time when interest rates remain high, while bellwethers like Target Corp. and Walmart Inc. have flagged concerns about the health of the consumer — the engine that powers two-thirds of the US economy.

Read More: Profit Recession Ends as a Challenging Holiday Season Begins

A Citigroup index shows downgrades to US earnings estimates have outnumbered upgrades for nine weeks in a row — the longest streak since February. Chronert — an equity strategist at the bank — does expect analysts’ estimates for 2024 to drop in the coming quarter — but that would only lower the bar for companies, he said.

When it comes to 2024 earnings, he sees “a more consistent” growth outlook for sectors despite the risk of an economic contraction, Chronert wrote in a note dated Nov. 17. “Our top-down view is that earnings can grow even in a mild recession.”

In July, Chronert raised his end-2023 target for the S&P 500 to 4,600 points following the sharp rally in the first half. The index is now less than 2% away from that level.