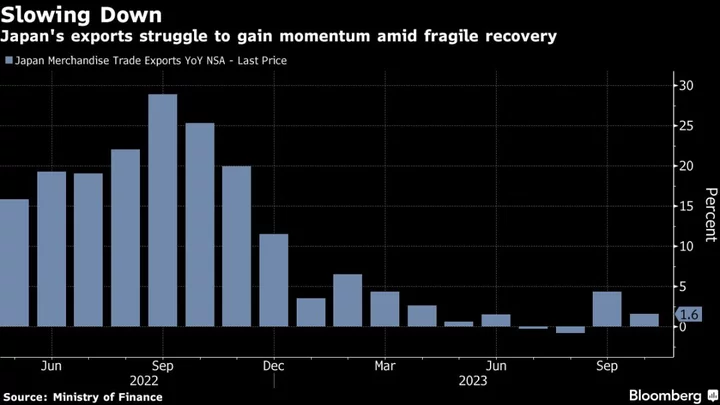

Japan’s exports rose at a slower pace in October, offering little extra support as the nation’s economy tries to avoid a technical recession in the second half.

The value of exports gained 1.6% from a year earlier, slowing from a 4.3% increase in the previous month, the finance ministry reported Thursday. Economists had forecast a 1% increase. Shipments were pushed up by a solid gain in cars especially to the US, but gains were limited by continued double-digit declines in chip-making gear exports.

Imports slipped 12.5% largely on the back of falling energy-related purchases. Still, the trade balance swung back to a deficit of ¥662.5 billion ($4.4 billion).

The slowing exports suggest another source of uncertainty for Japan at a time when sticky inflation and limited wage growth are keeping a lid on domestic demand. In the third quarter, business investment dipped while consumer spending failed to recover, resulting in a deeper-than-expected contraction for the Japanese economy.

A stronger showing from exports in the last three months of the year will be one of the keys to help the nation avoid a second straight quarterly contraction, but that depends on solid demand from Japan’s key markets.

“The US economy is likely to slow down, though it won’t contract. European economies are already decelerating, and China continues to stall,” said Taro Saito, head of economic research at NLI Research Institute. “Overall, overseas economies aren’t in a favorable situation for exports and I think things will worsen from here.”

For the October report, the average exchange rate was 148.88 yen against the dollar, with the yen 2.6% weaker than a year ago, a move that should have given a leg up for shipments abroad.

The Japanese currency has been hovering near its lowest level since October last year, when the government was forced to step in to support it for the first time in decades. This year the yen has dropped around 13% against the dollar, and around 14% against the euro so far.

What Bloomberg Economics Says...

“Without the boost from volatile items such as ships and mining machinery, October’s export slowdown would have been even more pronounced — and other details of the data suggest trade faces a rockier road ahead.”

— Taro Kimura, economist

For the full report, click here

Global commerce is expected to grow at a slower-than-forecast pace this year, according to the World Trade Organization. Geopolitical tensions, amplified by wars in the Middle East and Ukraine, are clouding the outlook.

Japan’s exports to China fell 4%, while those to the US and the EU increased 8.4% and 8.9% respectively. The gain in the value of shipments to Europe was the smallest since March.

Overall, the drop in exports to China was the smallest since May, but shipments of food more than halved from a year earlier. While food shipments usually account for little more than 1% of Japan’s exports to China, the sharp drop may reflect the impact of a seafood ban imposed by Beijing following the release of wastewater into the sea from the nuclear accident site in Fukushima.

Still, there are some signs of recovery emerging in China. Consumer spending in the world’s second largest economy outperformed expectations in October, providing a needed boost to the country’s economy as policymakers weigh more stimulus to support the rebound into the new year.

Japan’s Prime Minister Fumio Kishida has also taken steps to support the economy with a stimulus package worth more than ¥17 trillion. The measures center on income tax cuts and handouts to low-income households to help them deal with higher prices.

The yen’s slide has also helped lure in more tourists from abroad, and the number of visitors has recently recovered to pre-pandemic levels, in a potential bright spot for Japan’s economy.

--With assistance from Erica Yokoyama.

(Updates with more details from report, economist comments)