Mitsubishi UFJ Financial Group Inc. is in talks with companies behind popular global stablecoins as well as other firms about issuing such tokens via the Japanese banking giant’s blockchain platform.

Japan’s stablecoin law, one of the first among major economies, became operative on June 1 and in effect means that only the nation’s licensed banks, registered money transfer agents and trust companies can issue the tokens.

MUFG is in discussions with multiple parties about using its blockchain platform, Progmat, to mint stablecoins tied to foreign currencies — including the US dollar — for use globally, the bank’s Vice President of Product Tatsuya Saito said in an interview.

“Issuers and users can feel safe using stablecoins” now legislation is in effect, Saito said. He declined to specify which stablecoin parties MUFG is talking to.

Stablecoins are key parts of the crypto sector where investors often park funds in between trades involving more volatile tokens. They are meant to hold a steady value, typically $1, and are often backed by reserves like cash and bonds. About $130 billion are in circulation, according to CoinGecko data.

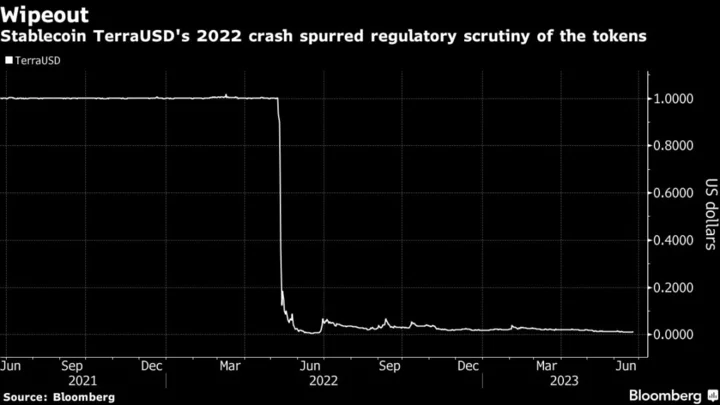

Stablecoins have periodically lost their pegs, roiling crypto markets. A token known as TerraUSD that relied on algorithms and trader incentives imploded in May 2022, part of a wipeout that cost at least $40 billion.

Regulators as a result stepped up scrutiny of stablecoins. Japan’s legislation promotes tokens that are fully backed by fiat cash in a matching currency.

MUFG envisages using Progmat to issue security tokens for third parties and has no plan at the moment for its own stablecoin, Saito said.

He added the bank is discussing stablecoin projects with entertainment firms, other non-financial businesses and a group of Japanese financial institutions. Inquiries are coming in from overseas financial groups and Japan could become a global hub for stablecoin issuance, Saito added.

The top stablecoin, Tether, accounts for more than 60% of the sector’s market value. Circle Internet Financial Ltd.’s USD Coin ranks in second spot. Issuers would need to adhere to Japan’s legislation to produce their tokens there.

The fact that stablecoins can be denominated in dollars and other currencies under the regulation paves the way to issue tokens for overseas use, Saito said. “This is a great opportunity for Japan,” he added.

Prime Minister Fumio Kishida’s agenda for reinvigorating Japan’s economy under the rubric of “New Capitalism” includes support for the growth of so-called Web3 firms. The term “Web3” refers to a vision of a decentralized internet built around blockchains, crypto’s underlying technology.

Japan has moved toward easing some crypto rules, such as on token listing and taxation, but overall is viewed as having strict regulations.