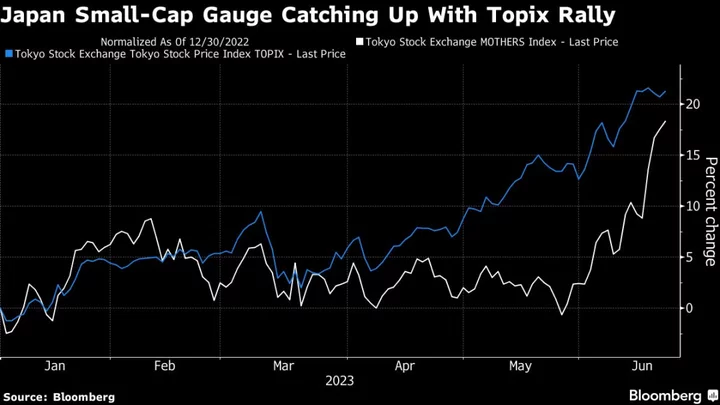

Japan’s startup equity gauge has accelerated gains in the past few weeks to nearly catch up to the benchmark index, as investors look to smaller stocks to broaden opportunities to ride one of the year’s hottest rallies.

The TSE Mothers Index is now up 18% year to date, compared with the 21% gain in the Topix that has left US and global peers in the dust. The Topix has been driven by venerable names including Toyota Motor Corp. and the trading houses favored by Warren Buffett, while Mothers’ biggest drivers include young firms engaged in artificial intelligence, fintech and human resources technology.

“To make money in Japan, you can invest in international companies that are headquartered in Japan,” Masakazu Takeda, a portfolio manager at Sparx Asia Investment Advisors Ltd., told Bloomberg TV. “You can also invest in small-cap companies that have innovative business models that can grow in a very mature economy.”

The bulk of the Mothers’ gain for the year has come this month. Its advance picked up steam in recent weeks on a rotation into overlooked sectors amid the excitement over electric vehicles that has helped power Toyota and the AI push that has boosted Japan’s semiconductor-related stocks.

“There is no doubt that investors are broadening their investment targets,” said Mamoru Shimode, chief strategist at Resona Asset Management Co. “Investors have been focusing on buying growth stocks and are now shifting their funds to lagging stocks.”

The Mothers board for startups was replaced by the “Growth” section of the Tokyo Stock Exchange following its reform in April 2022 but the index is still tracked by investors.

An upcoming rush of initial public offerings has lifted sentiment toward startups as well. More than 10 new stocks are expected to start trading in Tokyo between now and the end of June, according to data from the bourse.

“With macro events having run their course and lack of materials until the quarterly earnings announcements, large-cap stocks are likely to take a pause,” said Rina Oshimo, a strategist at Okasan Securities Co. “Meanwhile, IPOs are resuming, and there seems to be a virtuous cycle of funds flowing from selling public stocks to existing small- and mid-cap stocks.”

Strong recent performers include Abeja Inc., a company that uses AI modeling to provide digital transformation services, whose shares are up sixfold since listing last week. “VTuber” agency Cover Corp. is the biggest contributor to the Mothers’ gains this year, nearly quadrupling and pushing its market value to about $1.3 billion since its March IPO. Other big boosts to the gauge include AI firms Appier Group Inc. and Exawizards Inc.

Mothers comprises about 300 startups, compared with the over 2,000 stocks in the Topix. Companies included in the Topix have a total market value of about $3 trillion, dwarfing Mothers’ $19 billion.

--With assistance from Filipe Pacheco and Joanne Wong.