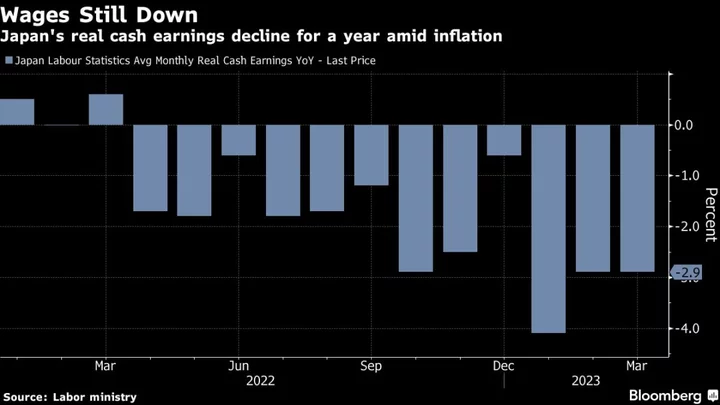

Japanese workers’ real wages continued to fall in March, in a weaker-than-expected result for pay that’s under close scrutiny from both the Bank of Japan and Prime Minister Fumio Kishida.

Monthly real cash earnings for Japan’s workers dropped 2.9% from a year earlier, slipping for a 12th straight month, the labor ministry reported Tuesday. Economists had forecast a 2.4% decline.

Nominal cash earnings gained 0.8% from the previous year to reach 291,081 yen ($2,150) for the month, below analysts’ expectations and far from the 3% increase flagged by policymakers as necessary for supporting inflation.

Another weak result in wages adds to BOJ Governor Kazuo Ueda’s argument for maintaining easy policy for now. Falling real wages also point to declining spending power for voters as speculation continues that Kishida is mulling the possibility of an early election.

Clarifying the importance of pay for the central bank, the BOJ added a reference to wages in its policy guidance at the April meeting, Ueda’s first at the helm.

The governor said in parliament on Tuesday that he was closely watching wage growth to see how sustainable it is for achieving the central bank’s 2% inflation target stably.

Read more: BOJ’s Ueda Gains Flexibility After Scrapping Guidance on Rates

“The BOJ won’t change its policy until its price target is met,” said economist Yuichi Kodama at Meiji Yasuda Research Institute. “The possibility of hitting the target is rising, but there’s still a distance to it. I don’t expect a major policy shift like scrapping yield curve control this year.”

What Bloomberg Economics Says...

“Looking ahead, April wage data will provide a critical read on the extent that pay increases that were negotiated in the annual spring wage talks (shunto) are feeding into household incomes..”

— Taro Kimura, economist

For the full report, click here

Still, the BOJ is relatively optimistic about wage increases this fiscal year. In its most recent quarterly report, the bank said that the results of the wage talks to date suggest sizable gains in both small and large businesses as well as part-time workers, citing figures from Japan’s labor union Rengo.

Ueda said he expects wage growth to rise as a trend supported by a tight labor market and actual inflation data, though he also indicated cautiousness.

“There are various uncertainties over this outlook” including how widespread wage growth will be among small businesses and if this year’s wage increases will continue, Ueda said.

Read More: Ueda Says BOJ Will End YCC Once Stable Inflation Target in Sight

Kishida is continuing to keep an eye on wage momentum, too. The prime minister attended Rengo’s May Day convention and said that in particular he wants to improve incomes for the younger generation.

In recent weeks support for Kishida has been increasing as he benefits from his firm stance on Ukraine and rapprochement with South Korea among other factors.

The timing of any early poll vote could play into central bank policy, as the BOJ may come under pressure not to make any changes that could cause ructions in the markets during a campaign period.

A separate report showed that Japan’s households cut spending in March, falling 0.8% from a month earlier, pointing to the impact of inflation.

Weak private consumption could be another drag on the country’s economic recovery, which has been impacted by the global slowdown. Next week, Japan will release figures for its first-quarter gross domestic product.

--With assistance from Isabel Reynolds and Toru Fujioka.

(Updates with more details, BOJ Ueda comments)