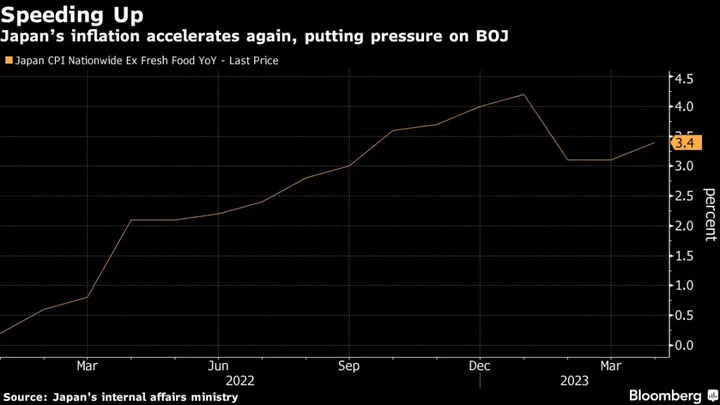

Japan’s inflation re-accelerated in April after months of cooling, likely reinforcing views that the central bank may have to revise its price outlook, bringing the Bank of Japan a step closer to policy normalization.

Consumer prices excluding fresh food rose 3.4% from a year ago, quickening from the previous month driven by gains in processed food and hotel prices, the internal affairs ministry reported Friday. The result came in line with analyst forecasts.

The national data was consistent with the results of the leading Tokyo figures, which showed renewed upward momentum after two months of deceleration.

The acceleration in the key inflation gauge will likely cement the view of many Bank of Japan watchers that the central bank will bump up its price forecasts, leading to speculation over policy adjustment as early as July this year.

In the latest quarterly outlook report, the BOJ projected core prices rising at just 1.6% in fiscal 2025, implying that the bank’s 2% sustainable inflation goal won’t be achieved within its forecast period.

At the same time, new BOJ Governor Kazuo Ueda has indicated that once the inflation target comes into sight, he would adjust existing policy, including the yield curve control program.

Read more: Japan’s Sticky Prices Seen Pushing BOJ to Mull Higher Forecasts

Prices excluding the impact from energy and fresh food, a measure of the deeper inflation trend, also quickened to the fastest pace since 1981. Tokyo data earlier showed prices jumping after the costs for services such as deliveries and train tickets were raised as the new fiscal year began in April.

Food price hikes also don’t seem to be ending anytime soon. About 5,600 food items are expected to rise in price from June onward, according to a Teikoku Databank report. “Food price increases will continue at least until this fall,” the data firm said.

What Bloomberg Economics Says...

“Japan’s April CPI report will likely confirm an early, somewhat alarming (for the Bank of Japan) signal from the Tokyo data — cost-push inflation pressures are heating up again. We think it will be enough to prompt the BOJ to raise its inflation forecast again, after having just lifted its projection in its April report.”

— Asia economist team

Click here to read the full report.

(Updates with more details from report)