Japan’s fishing industry is getting hit with falling prices and growing uncertainty after the Chinese government imposed a ban on the country’s marine products in response to its decision to release wastewater from the Fukushima nuclear site into the Pacific Ocean.

China is the largest single market for Japanese seafood exports at 87.1 billion yen ($600 million) last year, according to government trade statistics. Among the most popular products are scallops, tuna, sea urchin, snapper and sea cucumbers or namako.

The averge price of fresh Aomori tuna at the Toyosu market fell 24% on August 25 from the previous day to 9,383 yen per kilogram, according to data posted on the Tokyo Metropolitan Central Wholesale Market website. One Hokkaido firm that specializes in exports to China and Hong Kong plans to shut down and lay off its 20-person staff, according to a person at the company that asked for anonymity as it sorts through its financial affairs.

Gen Komori, president of Housen Co., a Tokyo-based trading company specializing in fishery products, said that now that exports to China have been cut off, the company has to shift its attention to Europe, the United States and Southeast Asia.

“It’s tough, but we have to try,” he said. “Companies that export exclusively to China have nothing they can do.”

A representative of Hashiguchi Suisan, which farms and processes yellowtail and tuna in Nagasaki Prefecture, said that the company exports about one-tenth of its total volume to China, and that the latest measure will eliminate sales by hundreds of millions of yen. He hopes that the Japanese government will consider a policy to compensate fishermen for the maintenance and other costs involved in holding fish.

Fresh fish exports to China had already began to decline in July when China tightened inspection standards, says fishery analyst Momoo Odaira. But this time around, frozen products and some processed products are also being cut off from China’s vast market. Coming at a time when the fishery industry was looking to ramp up exports with the weak yen, a total embargo is expected to have significant impact, he said.

“Products that were exported to China must be sold domestically or sold to other countries such as Thailand, Vietnam and Singapore,” he said. “As competition in other countries intensifies, fish prices are likely to fall.”

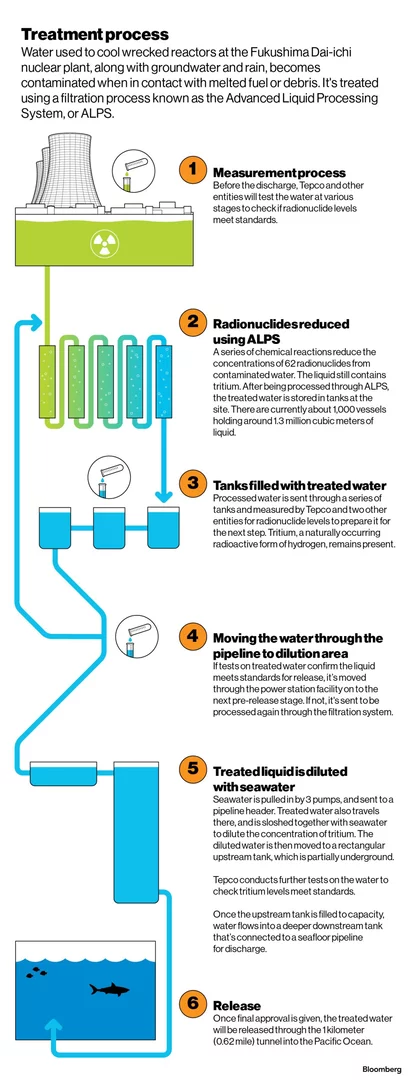

China had already banned food imports from 10 prefectures, including Fukushima, but expanded the measure to a full embargo after Tokyo Electric Power Co. began discharging the treated water from Fukushima this week.

Finance Minister Shunichi Suzuki, at a post-cabinet press conference, called on China to immediately lift the embargo and said that the Japanese government should “seriously consider what kind of relief measures can be taken” for fishermen.

Takahide Kiuchi, an economist at Nomura Research Institute, said in a column that seafood exports to China and Hong Kong account for only 0.17% of total exports and that “the impact on Japan’s exports and economy is limited.” However, if China’s trade restrictions on Japan expand to other sectors, the Japanese economy will suffer a more serious blow, he said.

Kazuma Kishikawa, an economist at Daiwa Institute of Research, Ltd., said that half of Japan’s fisheries exports go to China, Taiwan, and Hong Kong, and that fishermen would lose 50% of their overseas sales, which would be a “considerable blow.”

--With assistance from Shoko Oda and Emi Urabe.