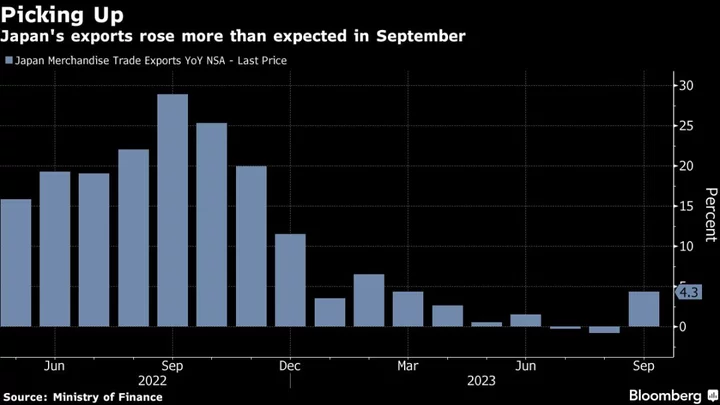

Japan’s exports rose more than expected in September, supporting the nation’s moderate recovery from the pandemic.

The value of exports gained 4.3% from a year earlier, led by shipments of cars and medical supplies in the first overall rise in three months, the finance ministry reported Thursday. Economists had forecast a 3% increase. Imports fell 16.3%, dragged down by crude oil, liquid natural gas and coal.

The trade balance swung to a surplus of ¥62.4 billion ($417 million).

The resilient external demand supports the economy with a weak yen helping exporters become more competitive. At home, though, sticky inflation continues to weigh on domestic demand with wage growth lagging behind price gains. In the second quarter, the economy expanded mainly on the back of overseas demand.

“Exports were strong in September, though their sustainability is questionable,” said Kota Suzuki, an economist at Daiwa Securities Co. “The US economy is strong at the moment, but it’s likely to slow down gradually.”

What Bloomberg Economics Says...

“Japan’s September trade data suggest healing supply chains continue to support exports even as foreign demand weakens. Stronger-than-expected shipments won’t stop GDP from shrinking in the 3Q but they will probably mitigate the drop.”

— Taro Kimura, economist

For the full report, click here

Exports to China fell 6.2% while those to the US and Europe gained 13% and 12.9%, respectively. Economic slowdowns around the world, particularly in China, have been a concern for Japanese exporters. Tensions over the release of treated wastewater off the coast of Fukushima simmer between the two nations, with Beijing banning Japanese seafood imports. Shipments of food to China dropped by 58% compared to the year before.

Geopolitical risks such as contaminated water and “tensions between the US and China will continue to weigh on shipments to China,” said Daiwa’s Suzuki. “Exports to China will likely remain sluggish for some time, since shipments of semiconductors and other electronic components to the country are not growing.”

Still, economic activity in China has shown some signs of stabilization in recent weeks. The world’s second largest economy beat forecasts in the third quarter as the government increased support and consumer spending picked up.

In Japan, a drop in imports shows cost-driven inflation is moderating, which may help with domestic activities. But rising oil prices and a weaker yen would likely reverse the trend, refueling inflationary pressure. The Bank of Japan is said to be preparing to discuss raising its price projections for fiscal year 2023 and 2024 at its policy meeting later this month.

For the trade data, the average exchange rate was 146.44 yen against the dollar, with the yen 4.7% weaker than a year ago. The Japanese currency has fallen partly because the BOJ’s dovish policy remains an outlier amid a wave of interest rate hikes by overseas peers intended to cool inflation. Japanese officials have stepped up their verbal warnings over the yen.

Meanwhile, the yen’s weakness has been a boon for foreign visitors to Japan. Their spending exceeded pre-pandemic levels in the third quarter while the number of visitors recovered to 96% of such levels in September. Chinese visitors accounted for the biggest portion of spending in the quarterly data, at 20% of total outlays, although arrivals from China were down in September from August.

(Updates with economist comments, more details)