China’s struggle with a weak yuan extends far beyond how it trades against the dollar.

The People’s Bank of China has been supporting the yuan versus 23 trading partners’ exchange rates — including the euro, yen and pound — with its daily fixings against these currencies since mid-August, according to calculations by Bloomberg. That has resulted in the stabilization of an official gauge measuring the yuan’s value versus peers.

Traders have sold the yuan this year as disappointing economic data and turmoil in the real estate sector spurred the central bank to cut interest rates. As its monetary policy diverges with the rest of the world and weakens its currency, Chinese officials have to weigh how that may lead to capital outflows as confidence weakens.

While there has been less attention on the PBOC’s efforts to prop up the currency against other major peers, it seems to be working. The trade-weighted basket has gained about 1.2% since the end of July, while the onshore yuan has weakened around 2% versus the greenback during the period.

“Boosting export competitiveness by allowing the yuan to weaken more drastically at this point could reap less looking at slowing global demand,” said Fiona Lim, a senior foreign-exchange analyst at Malayan Banking Berhad in Singapore. Further weakness would “cost more in terms of confidence, capital outflows and financial stability,” she said.

The PBOC has been digging deeper into its policy tool kit to stem a slide in the currency, as the yuan slid to a 16-year low against the dollar last week.

The currency stabilized this week as authorities delivered their most forceful defense yet through verbal warnings and set the dollar-yuan reference rate at the strongest margin on record.

To be sure, the yuan basket index’s relative stability may also be partly due to Asian currencies’ weakness against the dollar on bets that the Federal Reserve may keep interest rates higher for longer. The yen and the South Korean won are down more than 3% versus the greenback since late July.

Non-Dollar Fixings

The yuan is allowed to trade in a range from 2% to as much as 10% around the PBOC’s reference rates on a daily basis. Market makers submit their suggested rates — estimated based on the prior close and expected transactions — to the central bank, which then makes a final decision on the daily fix.

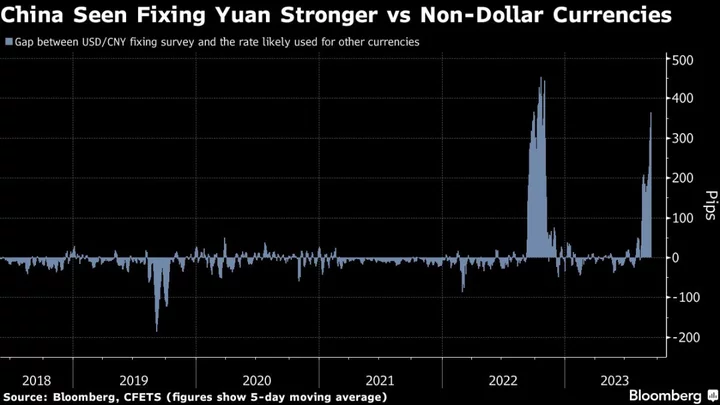

Bloomberg’s analysis going back to 2018 shows the fixings for non-dollar currencies have rarely deviated from market trends — unlike against the greenback — probably due to a lack of liquidity and less significance to policymakers.

Yet they have started to carry a stronger bias in the past couple of weeks.

By deriving the dollar-yuan rate underlying the fix for other currencies, and comparing it to a daily Bloomberg survey, the analysis indicates the PBOC has been setting the yuan at a level 0.5% stronger than market expectations on a five-day moving average. That gap is the widest since November last year when China’s currency was experiencing a bout of weakness.

For example, the euro-yuan fixing was set at 7.7919 on Wednesday. Based on the euro-dollar rate of 1.076 as of 9 a.m., it suggests the dollar-yuan rate used by the PBOC was 7.2415 — which is nearly 400 pips, or about 0.5%, stronger than the 7.2808 average expected from a survey of analysts and traders.

The greenback’s 20% weight in the CFETS RMB Index suggests the dollar-yuan reference rate alone won’t be enough to support the trade-weighted basket, indicating that the PBOC may have implemented some adjustments to its fixings in non-dollar rates.

(Updates with more details on the methodology.)