Italy will manage to bring its budget deficit below the limit set by the European Union only in 2026, delaying an earlier objective and risking a confrontation with Brussels.

The right-wing government of Prime Minister Giorgia Meloni postponed by a year pulling the deficit under the EU’s ceiling of 3% of gross domestic product, according to a budget plan approved by the cabinet late Wednesday. The bloc is set to reimpose the limit in January.

“We believe we have done the right things,” Finance Minister Giancarlo Giorgetti told reporters after the cabinet meeting. “We don’t respect the 3%” limit, Giorgetti acknowledged, adding that Rome is determined to avoid a recession.

The budget plan underscores the challenge Meloni faces in balancing tax-cut promises and souring economic growth. Italy is not the only country struggling to meet EU fiscal rules. France will have a deficit of 4.7% this year and Spain of 4.1%, according to Bloomberg forecasts.

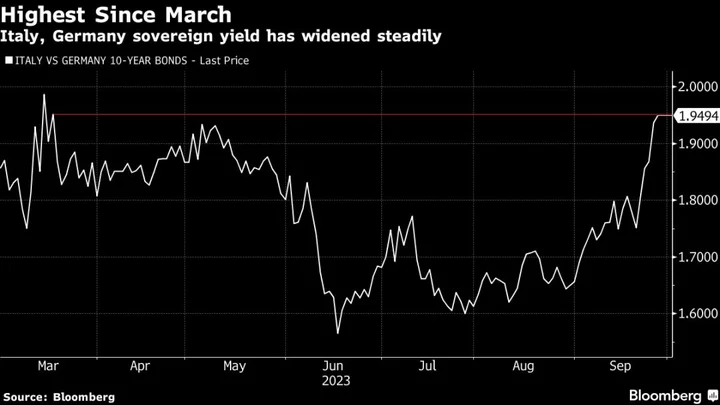

Italian government bonds opened little changed on Thursday, with the yield spread to German bonds remaining below 200 basis points. The gap, a common measure of risk, has climbed about 30 basis points this month, the most since April 2022.

Under the budget plan, the government targets a wider budget deficit than previously set this year and next. The 2023 deficit is seen at 5.3% of GDP, compared with an earlier 4.5%, Giorgetti said. For 2024, the deficit is seen at 4.3%, compared with 3.7% as targeted in April.

Giorgetti blamed interest rate hikes by the European Central Bank, as well as Russia’s invasion of Ukraine, for slower growth. The larger deficit will “allow us to confirm measures for lower-income families and in particular tax cuts on wages, measures to boost births” and significant resources for the public administration, he said.

The plan targets debt at 140.1% of GDP next year, with growth is seen at 1.2% in 2024, 1.4% in 2025 and 1% in 2026.

Further complicating the presentation of the government’s fiscal plans has been the change in accounting treatment of housing renovation incentives known as the superbonus. That measure was eliminated by Meloni’s coalition, but continues to impact the public finances.

Ever since the economic data started visibly souring — implying a likely hit to the government revenues — Meloni’s three-party coalition has been at pains to find new cash to square its generous electoral pledges with the need to keep Italy’s debt on a sustainable path.

It’s not yet clear how much trouble Italy will incur with an overshoot of the 3% deficit limit next year. EU finance ministers are still negotiating over how stringently the rule should apply, and whether the European Commission, the EU’s executive arm, should apply country-specific criteria in certain cases.

--With assistance from Giovanni Salzano and Aline Oyamada.

(Updates with bonds reaction in fifth paragraph)