Italy’s banks are paying the price for Prime Minister Giorgia Meloni’s need to cater to the more populist elements in her right-wing coalition.

The latest pact between Meloni and Deputy Premier Matteo Salvini, on a surprise 40% tax on bank earnings which rocked markets, was discussed Sunday night, according to people familiar with the issue. The setting: a dinner of Fiorentina steak and Chianti wine with their partners near the Tuscan coast.

The last-minute decision meant that the policy was full of holes when it was announced by Salvini 24 hours later. Finance ministry officials spent Tuesday trying to work out how to implement their bosses’ broad-brush plans and how to reassure investors as bank stocks plummeted, said the people who asked not to be named on a confidential matter.

The outcome was late-night backtracking before an official clarification to explain the levy’s impact would be limited for many lenders. About $10 billion was wiped from banks’ market value before shares slowly recovering Wednesday.

https://t.co/z0bPJ7YkwY

— Corriere della Sera (@Corriere) August 9, 2023It was only Wednesday afternoon that Meloni broke her silence on the tax. She said in a Facebook video that given increases in prices and the cost of mortgages, “in this situation it is key that the banking system behave as fairly as possible.”

Meloni said the levy was a result of the banks’ behavior, and also said the efficacy of the European Central Bank’s interest hikes was “questionable.” She added that the rate hikes for banks were mostly not followed by increases in deposit rates “and so we saw banks recording record profits, so we decided to intervene with the only instrument the government has: taxes.”

“This is a self-destructive move by the government which is devastating for the country’s reputation,” said Carlo Alberto Carnevale Maffe, professor of business strategy at Milan’s Bocconi University.

He noted the government changed the details of the levy repeatedly.

“They have undone in one night the credibility which had been painstakingly built up with a cautious attitude toward markets and investors in the first months of the government,” Carnevale Maffe said.

This is the second time that Meloni has spooked markets. In April, shares in energy company Enel SpA slumped after she cut an eleventh-hour deal with Salvini, who leads the powerful anti-migrant League party, and other coalition partners nominating Flavio Cattaneo for the post instead of her preferred choice.

Each time Salvini has insisted on pushing his populist agenda, Italy’s first female premier has remained silent, letting things play out in the markets and waiting for the storm to pass.

Meloni kept her distance. She and Finance Minister Giancarlo Giorgetti were both conspicuously absent when Salvini announced the tax during a press conference. She chose to let Salvini take center-stage on the levy, to grant her ally a political victory and in an attempt not to jeopardize her image as a pro-market figure, the people said.

But she backs the tax in a bid to cement the electoral base of her far-right Brothers of Italy, the biggest force in the three-party coalition, said the people. She also aims to reinforce her alliance with Salvini.

Italian politics have been in a state of flux since the death of former premier Silvio Berlusconi in June. That leaves his Forza Italia party without its standard bearer and its voters up for grabs. It also makes Meloni and Salvini, who could strengthen his hand with Forza votes, the two most important politicians on the Italian right.

Hurried Affair

The decree was a hurried affair. Agreed on Sunday, it was imposed on a reluctant Giorgetti and his finance ministry, the people said.

Giovanbattista Fazzolari, an undersecretary in Meloni’s office, defended the tax as “common sense.” The levy “won’t make things difficult for banks, investors can rest easy,” he told newswire Ansa. “This is the only government which has the strength to tax the banks because it’s the only one that doesn’t have privileged relations with the banking system.”

But Francesco Giavazzi, formerly economic adviser to then-Premier Mario Draghi, criticized Meloni’s government for its handling of the measure.

“New rules should be explained,” Giavazzi told newspaper Corriere della Sera. “International investors expect the finance minister to explain such a decision and not, as it happened, to have the man in charge of bridges” — a reference to Salvini’s role as transportation and infrastructure minister. “If the treasury minister doesn’t show up at the press conference this is a terrible sign.”

Ultimately Meloni has few options but to periodically pacify her allies as she tries to stay afloat in Italy’s factious political system, which encourages big coalitions and makes it difficult for most executives to last to the end of their term. Salvini could easily start a government crisis if he decided to remove support in parliament.

Appeasement

While her strategy of appeasement has allowed Meloni to stay in power, it remains to be seen what the longer term impact of such uncertainty has on investors. So far, Meloni’s record on social issues has been heavily criticized by opponents for its right-wing and anti-LGBTQ+ stance on several matters including surrogacy, but her economic policy has been more well received.

She has kept the nation’s mammoth debt on a declining path and her first budget law was moderate and devoid of any excessive spending or other norms that could upset markets or the country’s European partners. That has kept the spread between Italian 10-year bonds and German counterparts well below 200 basis points for most of her premiership.

Meloni’s fiscal stance has also been helped by over €190 billion ($209 billion) in recovery cash from the European Union coming its way for investments in projects ranging from new schools to hospitals, roads, digitalization and more.

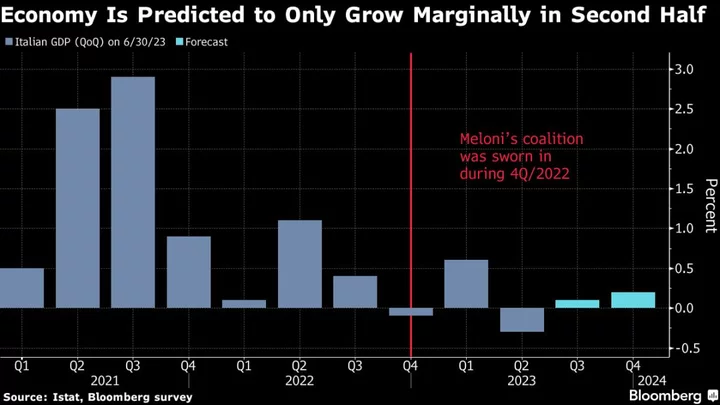

“This was a surprise, and not in a good way, and I think it will raise questions in investors’ minds — if banks, what could be next?” Katharine Neiss, chief European economist at PGIM Ltd, told Bloomberg TV’s Francine Lacqua. “We have to remember, this is happening against a backdrop of weakening growth.”

--With assistance from Tommaso Ebhardt, Craig Stirling and Antonio Vanuzzo.

(Updates with Meloni’s remarks in fifth, sixth paragraphs)

Author: Alessandra Migliaccio, Sonia Sirletti and Chiara Albanese