Thailand’s financial markets are set for a bumpy ride as investors may have to wait until August to find out whether a coalition of pro-democracy parties can take government after concerns about political jostling triggered the steepest post-poll selloff in two decades.

The uncertainty has triggered an outflow of funds since the May 14 vote, worsening the rout in Asia’s worst-performing stock market this year and sending the baht lower against the dollar. While the coalition formalized its alliance Monday, when the quarterly economic report showed better-than-expected growth, withdrawals may continue until there’s clarity on the new leadership.

“This is a classic case of politics getting in the way of an economic rebound in the making, which would certainly have been bullish for Thai assets,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore.

Thailand’s Election Commission has up to 60 days after the vote to release official election results and certify 95% of the lower house seats. The first session of the new parliament must then take place within 15 days. That pushes back the timeline of government formation to late July or even early August.

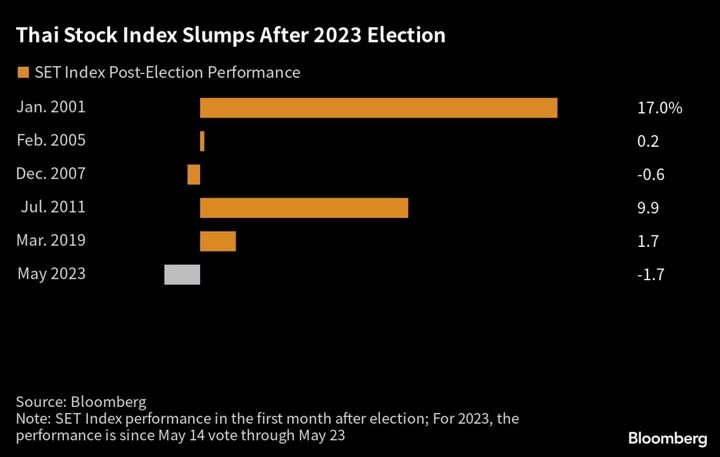

Overseas investors unloaded the nation’s bonds for a fifth day on Tuesday, with outflows totaling more than $1.2 billion over the period. They’ve sold off stocks for 11 straight days, withdrawing $725 million, according to data compiled by Bloomberg. The benchmark SET Index has fallen 1.7% since the election. The baht dropped to a two-month low on Tuesday.

The coalition forged by the Move Forward Party, which won the most seats in the election with 313, a clear majority in the 500-member House of Representatives. But as things stand, that’s still short of the 376 needed for Pita to become prime minister. He will require broader support from the military-appointed Senate, whose 250 members also vote on who will get the top job.

Better Wait

“It’s better for investors to wait it out until there’s confirmation on the government because the market is just reacting to every new development without insight on whether the direction of latest change will sustain,” said Alan Richardson, a fund manager at Samsung Asset Management Co.

Should the coalition manage to form a government, the parties are expected to follow through with their promises of giving cash handouts, increasing the minimum wage and boosting allowances for pensioners and the elderly. The Move Forward Party has also pledged to end business monopolies and promote more investment outside of Bangkok.

“We still expect the SET Index to move sideway until the parliament’s session to vote on the prime minister,” said Padon Vannarat, head of research at Yuanta Securities Pcl. “We have to watch the senators’ directions closely but we expect the index to rebound, especially when the parliament’s vote for a new PM gets closer.”

--With assistance from Ishika Mookerjee.

Author: Karl Lester M. Yap and Anuchit Nguyen