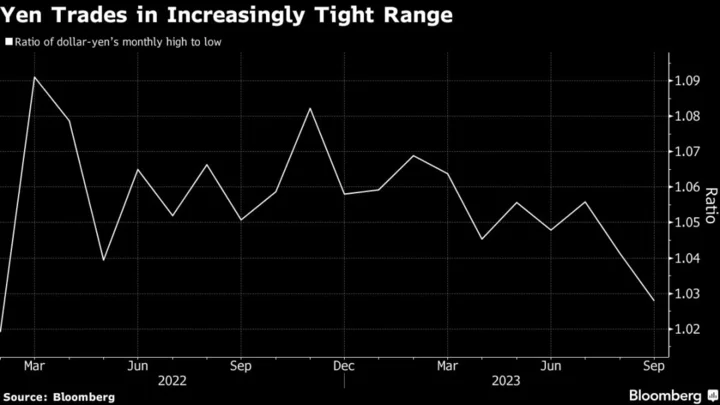

While the yen continues to slide, it’s doing so in the tightest monthly trading range in more than a year and a half as the threat of intervention from Japan keeps bears at bay.

The difference between dollar-yen’s highest and lowest levels in September is still just 2.8%, even after Japan’s currency touched the its weakest point in 10 months earlier Monday. The range was almost double at 5.6% in July when the Bank of Japan made an unexpected adjustment to its yield-curve settings.

It was back to being little changed at 148.36 as of 3:27 p.m. in Tokyo amid a long-term grind that has it approaching the psychologically important level of 150 versus the greenback. While the wide gap between interest rates in Japan and the US is driving the depreciation, repeated warnings from government officials has kept trading relatively orderly.

“We are approaching last year’s peak levels so in that sense, the alertness about intervention is increasing,” said Kaoru Shoji, a strategist at SMBC Nikko Securities Inc. “The market is trying to figure out what level of yen weakness will necessitate that intervention.”

The BOJ left its negative interest rate and the parameters of its yield-curve-control program intact on Friday. Governor Kazuo Ueda said the distance from being able to adjust the negative rate hasn’t changed much, tamping down speculation that the central bank would retire this policy tool by year end.

A speech on Monday by Ueda failed to have any immediate discernible impact on the yen. He said uncertainties regarding the sustainability of wages and inflation were high, and therefore the goal of achieving the BOJ’s 2% inflation gaol accompanied by wages gains had “not yet come in sight.”

The yen’s implied yields are below zero due to BOJ policy, making it a preferred source of funding among investors to buy higher-yielding currencies. Hedge funds and asset managers both held net short positions on the yen last week, based on the latest data from the Commodity Futures Trading Commission.

Prime Minister Fumio Kishida said last week that Japan would maintain high vigilance and take necessary action against excessive currency moves. Masato Kanda, the top currency official at the Ministry of Finance, has said he’s keeping in close contact with his counterparts in the US, adding that both sides agree that excessive moves are unwelcome.

If the BOJ and MOF are of one mind in not wanting to see a further rise in dollar-yen, “a fresh round of intervention, aimed at buying the BOJ more time before the conditions for a policy shift are deemed to be in place, looks an increasingly likely prospect,” National Australia Bank Ltd. strategists led by Ray Attrill wrote in a research note on Monday.

(Adds speech from BOJ’s Ueda in sixth paragraph.)