Sea Ltd.’s revenue missed estimates after its e-commerce division posted slowest growth on record, reflecting fallout from economic turbulence and intensifying competition.

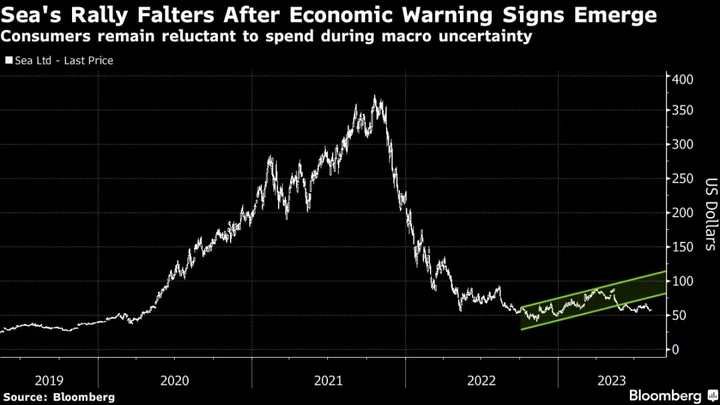

The stock fell 13% in pre-market trading. Second-quarter sales grew just 5.2%, underscoring the effects of a cut in promotional spending on e-commerce and a 41% decline in gaming revenue. The company had net income of $321.6 million, according to Bloomberg calculations based on first-half numbers, topping estimates.

Sea is focusing on profitability over the pursuit of growth, at a time consumers remain reluctant to spend during economic uncertainty. Singapore-based Sea last year embarked on an aggressive cost-cutting drive to reverse years of losses, pivoting to a focus on the bottom-line as revenue growth decelerated from the triple-digit percentage rates of just two years ago. The company froze salaries and slashed hundreds of millions of dollars in sales and marketing expenses to achieve positive cash flows.

The company, the largest of Southeast Asia’s internet firms and briefly the world’s best-performing stock, is pulling back on a once aggressive global expansion to focus on its core operations to win back investors. Last year was one of the most difficult for Sea since its founding in 2009: it shed about $160 billion of market value from its October 2021 peak as the market turned against money-losing tech companies.

Read more: Sea’s Path to Profit Paved With Layoffs, Single-Ply Toilet Paper

Second-quarter sales were $3.1 billion, trailing the $3.2 billion analysts estimated on average. Revenue growth at Shopee, Sea’s e-commerce unit, decelerated to 21%, the slowest on record. Revenue from SeaMoney, the digital financial services business, rose 53%.

What Bloomberg Intelligence Says

Sea’s rising e-commerce and fintech monetization, along with Garena’s greater user engagement, might let it meet expectations for higher sales and a third consecutive net profit in 2Q, despite slower growth in commerce and gaming amid sector headwinds. Shopee and fintech margin could widen due to improving unit economics. A rebound in Free Fire active users, distribution of Tencent’s Undawn and the release of Black Clover Mobile may jump-start the digital entertainment segment in coming quarters. These trends should endure amid higher transaction-based and value-added services for merchants, the Brazil unit’s improving economics and an expanding loan book. Free cash flow could stay positive for a third straight quarter as sustained net profit is maintained, helping strengthen cash balances.

- Nathan Naidu, analyst

Click here for the research.

Sea and its regional peers Grab Holdings Ltd. and GoTo Group continue to face challenges in an era of slowing economic growth, rising costs and a decline in technology company valuations. Grab and Indonesia’s GoTo Group continue to bleed losses.

Earlier Tuesday, GoTo cut its 2023 loss projection after staunching some of the bleeding in the latest quarter, taking the Indonesian company closer to its goal of getting into the black after an era of costly expansion. Grab is slated to report second-quarter results later this month.

Longer term, Sea hasn’t entirely withdrawn from global markets and its Latin American operation could help drive growth, said Nathan Naidu, an analyst at Bloomberg Intelligence.

“Sea’s e-commerce expansion in Latin America could kick sales growth back into high gear after a deliberate slowdown to achieve breakeven,” he wrote in a note ahead of the results.

(Updates with rivals’ performance in seventh paragraph)