After years of disappointing investors, Intel Corp. shares are showing signs of life.

The best performer in the Philadelphia Stock Exchange Semiconductor Index over the past month, Intel is being viewed as both a relative value play and a potential beneficiary of geopolitical tensions with China as the Santa Clara, California-based company bolsters chipmaking facilities in the US.

“Investors have a love-hate relationship with the stock,” said Hendi Susanto, portfolio manager at Gabelli Funds. “It isn’t out of the woods, but over the past several months Intel has demonstrated its resilience.”

The chipmaker’s shares are up by nearly 20% over the past three weeks, compared to a roughly 5% drop for Nvidia Corp. and a gain of less than 2% for the Philadelphia Stock Exchange Semiconductor Index. The outperformance comes as tensions between the US and China continue to escalate and despite lingering reservations on Wall Street that Intel’s expensive turnaround strategy — which hinges on reestablishing its once-bulletproof lead in chip technology — will succeed.

Shares were little changed on Wednesday.

Its plan involves heavy spending, with the chipmaker building and extending facilities in the US and Europe, something that may help it if the already fraught relationship between the US and China deteriorates further, creating more incentive for other companies to use it as an outsourced manufacturer.

This issue is center stage now that it has been reported China plans to widen a ban on the use of iPhones, a development that could have implications for major Asia-based manufacturers like Taiwan Semiconductor Manufacturing Co.

“With China ramping up tensions, the US has to have a backup plan to TSMC, and Intel is the only company capable of offering anything similar,” said Daniel Newman, chief executive officer of The Futurum Group. “Now that it is showing some momentum in its foundry business, it has become a really interesting play for long-term investors, especially since it had basically been written off, with a valuation that felt doomsday.”

Expectations for Intel’s adjusted 2023 earnings have jumped by 65% over the past three months. Recent strength was fueled by Chief Executive Officer Pat Gelsinger, who told investors at a recent conference “you have to be much less skeptical about our ability to pull this off.” He will also speak at an Intel event next week.

Intel’s CEO ‘Feeling Good’ About Quarterly Forecast; Stock Jumps

The stock trades at 2.9 times estimated sales, making it one of the cheapest by this metric in the semiconductor index. Nvidia Corp, which has more than tripled this year on the back of AI-related excitement, trades at nearly 16 times forward sales.

Still, Intel’s valuation is offset by a weak growth outlook. Revenue is expected to fall 17% this year, worse than the 8.6% drop Bloomberg Intelligence expects for the overall semiconductor sector. While Intel expects revenue to rise 12% in its next fiscal year, that trails the broader 15% growth expected.

That’s a key reason why hedge funds have dumped the stock, and why Wall Street remains skeptical about its prospects. In terms of its buy, hold, and sell ratings, it’s the lowest-rated company among the 30 components of the chipmaker index.

Shares remain down 15% over the last five years, compared with a 160% gain for the Philadelphia index over the same period.

“It isn’t a disaster story anymore, but I don’t want to be a buyer until it has a more established AI strategy or we get a greater sense that the turnaround is working,” said Ken Mahoney, CEO of Mahoney Asset Management. “It feels like Intel is still playing checkers while Nvidia is playing chess. It’s always running behind.”

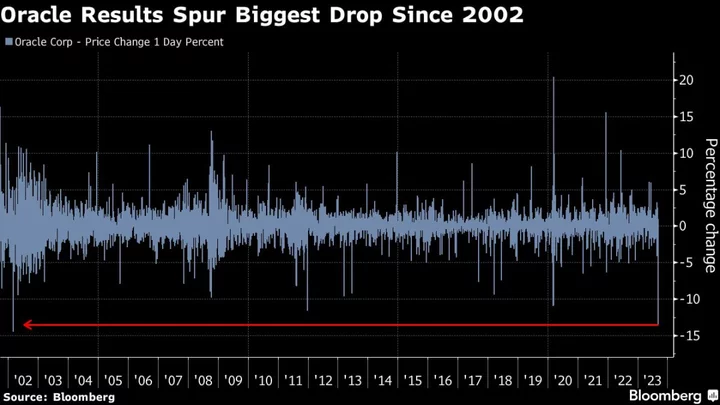

Tech Chart of the Day

Oracle shares sank 13.5% on Tuesday, the biggest one-day percentage drop for the stock since March 2002. The selloff followed the company’s results, which showed a slowdown in the growth of its cloud business. The stock remains up 34% this year, as of its last close.

Top Tech Stories

- Apple Inc. enacted its long-awaited iPhone price increase with as much subtlety as possible, part of an effort to wring more money from consumers without triggering sticker shock.

- In the first hands-on testing of the iPhone 15 Pro and Pro Max, the new materials and charging port stand out as the most distinct changes from last year’s models.

- One of India’s hottest tech companies, Byju’s allegedly hid $533 million in an obscure three-year-old hedge fund that once said its principal place of business was an IHOP pancake restaurant in Miami, according to lenders trying to recover the cash.

- T-Mobile US Inc. said it would buy airwaves from Comcast Corp. for between $1.2 billion and $3.3 billion in cash and expects to close the purchase by 2028, pending approval from the US Federal Communications Commission.

- Arm Holdings Ltd. is expecting to price its initial public offering at the top end of its range or even higher, according to people familiar with the matter.

- Square Enix Holdings Co. has shed nearly $2 billion of its value since Final Fantasy XVI, the latest installment of its global hit series, came out to mixed reviews. Now investors wonder whether one of the games industry’s most remarkable runs is coming to an end.

Earnings Due Wednesday

- Postmarket

- Semtech

--With assistance from Ian King and Subrat Patnaik.

(Updates to market open.)