For all the talk that US inflation is cooling, it sure doesn’t feel like anything is getting cheaper. That’s because most things aren’t.

Inflation is expressed as a rate of change, and it is true that prices are in fact growing at a slower rate — what’s known as disinflation. But to the average American, their lived experience is that everything is more expensive than it used to be, and that won’t change until there’s outright deflation.

While the consumer price index captures the headline rate of inflation, the Bureau of Labor Statistics also publishes a separate report of average price data that reflects what Americans are actually paying. It largely only covers food and drink categories, while the CPI shows inflation rates on a variety of goods and services across the economy.

Here are some average per-pound prices from before the pandemic and now:

Basic items like ground beef and potato chips now cost dollars more on average than they did before the pandemic, the BLS price data show. Gasoline prices are rising again and the costs of electricity and a variety of other everyday essentials remain elevated.

The latest CPI reading, due Thursday, is forecast to show that consumer prices grew 3.3% in July from a year ago, up slightly from the prior month but still near the slowest pace in two years. The inflation rate peaked at 9.1% last June, which was the highest in four decades.

Grocery prices have fallen in three of the last four months, based on the CPI data, but hardly enough to make a dent after two years of increases. Since February 2020, when the pandemic began, the cost of food at home is up more than 23%.

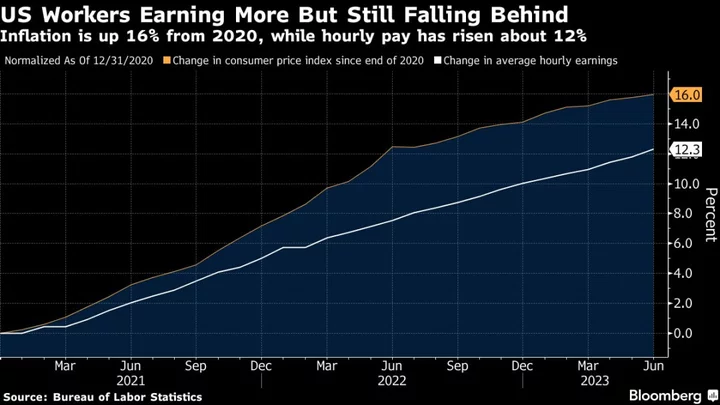

The problem is, wages largely haven’t kept up. Earnings growth only just started to outpace inflation in recent months, but before then, Americans had effectively experienced two years of declining purchasing power.

“People grumble when they get to the grocery store that everything is so expensive. I’m very much one of those people,” said Jennifer Lee, senior economist at BMO Capital Markets. “You just pay for it because you have to eat.”

That largely explains why Americans are fairly downbeat about their financial situations, dragging down measures of confidence. The University of Michigan’s consumer sentiment index was at 101 in February 2020 and sank to half that level — a record low — by June 2022 when inflation peaked.

It’s since recovered to 71.6, but remains well below its longer-run average.

Inflation has also been an overhang on Joe Biden’s presidency. His approval rating has consistently stayed below 50% in the past two years since price pressures ramped up, according to Gallup. While his economic policies may help the US avert a recession, the budget deficit is ballooning.

Read more: US Stripped of AAA Rating by Fitch as Budget Deficits Swell

“American voters are still spooked out by inflation. Bidenomics is not helping at all,” Greg Valliere, chief US policy strategist at AGF Investments Inc., said Monday on Bloomberg Television.

Easing inflation also doesn’t take away from all that Americans have sacrificed to adjust to a higher cost of living. They’ve largely been to relying more on credit cards and saving less, which has pushed up delinquency rates.

Granted, the pain would be much worse if not for the strong labor market. Employers continue to add jobs at a steady clip and unemployment remains near the lowest in decades, giving consumers the ability to keep spending.

--With assistance from Vince Golle.