Inflation is proving so sticky in Australia that the institution responsible for taming prices is itself facing the threat of strike action by staff demanding fatter pay checks.

Reserve Bank Governor Michele Bullock told a senate panel on Thursday that she doesn’t know “if the job is done yet” on containing prices. A day earlier, the Finance Sector Union dismissed the RBA’s latest pay offer, saying it would leave staff “in financial hardship for years to come” and it’s up to the governor to demonstrate she values bank employees.

The dispute represents a clash in two of Bullock’s key priorities since taking over last month: Bringing inflation back to the 2-3% target and changing the bank’s culture to empower staff to challenge the views of senior management.

The FSU and RBA will meet again on Nov. 6 after the union rejected an upwardly revised 11% pay increase over three years and warned of industrial action if wages don’t rise by more than inflation. But such a pace would go against the restraint the bank is calling for across the economy as it grapples with the worst inflation outbreak in a generation.

“It’s politically tough for the RBA to meet demands of the staff that are wanting pay rises that aren’t consistent with the inflation target,” said Gareth Aird, head of Australia economics at Commonwealth Bank of Australia. “The optics of it just don’t look good when you’re an inflation targeting central bank with inflation too high.”

The union says workers at the RBA deserve a “decent pay rise” instead of the current offer, which it says is below that of other government workers and what’s being paid by major banks.

“The clear message from our members at the RBA is that they are fed up with the Bank’s penny pinching and they are not prepared to accept anything short of a fair pay rise,” says FSU National Secretary Julia Angrisano.

The RBA says it’s continuing to engage with the union to come up with a solution.

‘First Test’

“One of the things that Michele came in with was to change the culture of the bank,” said Luke Hartigan, who left the RBA in 2021 to teach economics at the University of Sydney. “So I guess this is her first test.”

It’s also a case of be careful what you wish for. Before prices took off after the pandemic, Bullock’s predecessor Philip Lowe had routinely called for faster wage growth and said “it would be a good thing” if workers asked for a raise.

RBA governors are among the most highly-paid central bankers in the world with a salary of around A$1.1 million ($702,900) based on their experience and their potential in the private sector. Yet that doesn’t apply to all roles.

Hartigan said the RBA hires the “cream of the crop” and its analysts could easily earn A$150,000-A$200,000 in the private sector — roughly 30-50% more than what he reckons they make at the central bank currently.

The RBA declined to comment on the union’s intention in relation to the industrial action, saying that management is continuing to engage in the bargaining process “with a view to finalizing an agreement that recognises the contributions of our people as well as being the right thing to do in the current economic environment.”

While the RBA’s decision won’t have a direct implication on economy-wide wage growth, it may feed into other pay negotiations.

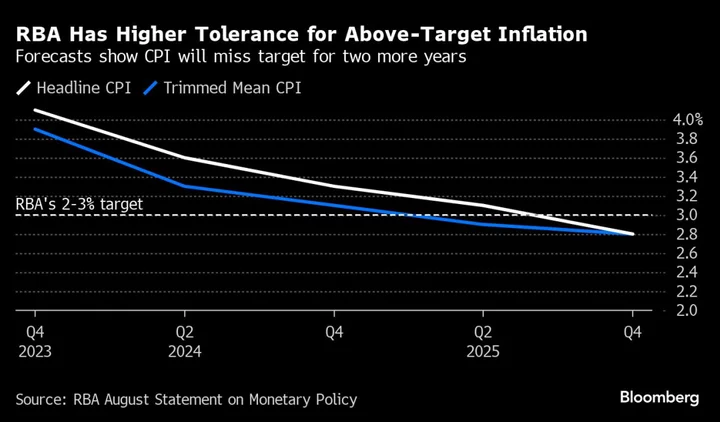

Australia’s core inflation - which strips out volatile items - remains higher than that in the US, Canada and Europe. Figures this week showed a rapid acceleration in the quarterly inflation pace to 1.2% from the prior three month period’s 0.8%.

Persistently strong inflation is eating into households’ disposable income, with the RBA’s own research showing a small, yet growing, number of households in financial stress.

Bullock isn’t alone in dealing with agitating staff.

Last year, European Central Bank’s Christine Lagarde rejected calls by staff to link salary increases to inflation, while Bank of England chief Andrew Bailey passed up a pay rise after asking high earners to help keep inflation in check by holding off on making aggressive demands. In 2022, staff at Brazil’s central bank went on a strike demanding wage raises to recover lost purchasing power.

The RBA, headquartered in Sydney’s Martin Place, had 1,575 workers as of June 2023. The Finance Sector Union said it is unclear how many would participate in an industrial action if one were to occur.

There hasn’t been a strike at the RBA in living memory, so present and former staff were unclear on what form or shape one would take if the union did decide to go down that path. It’s also unclear if there would be a disruption to any essential activities.

“It would be unlikely that more senior staff would engage in industrial action,” said Jonathan Kearns, who left the central bank as the head of the financial stability department this year to take a chief economist role at Challenger Ltd. “So even if you had some staff engaging in a strike, chances are some of those key things like the weekly open market operations would still be able to occur.”

Those operations are among the most critical functions of the RBA as they ensure there’s enough liquidity in the financial system. The research department is key for policy making as they provide economic analysis and advice to the rate-setting board.

That advice will be crucial for Bullock’s other looming test: Whether to deliver her first interest-rate hike as governor at the Nov. 7 meeting.

(Adds date of next RBA-Union meeting in fourth paragraph.)