NEW DELHI (Reuters) -India's inflation has moderated, but lingering weather-related uncertainties still pose headwinds, the governor of the Reserve Bank of India said on Wednesday.

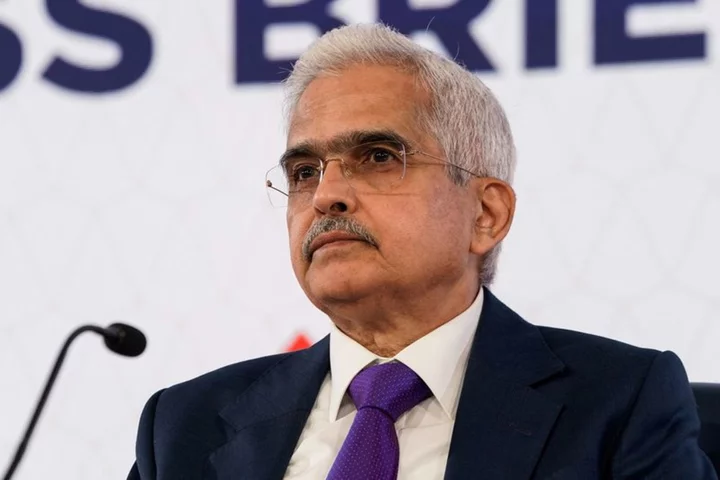

"The war on inflation is not over, we have to remain alert," Shaktikanta Das said at an event in New Delhi.

"There is no room for complacency. We will have to see how the El Nino factor plays out."

India's annual retail inflation eased to 4.7% in April from 5.66% in the previous month, according to government data.

This month's retail inflation data, scheduled to be released on June 12, "could perhaps be lower," Das said.

The RBI targets inflation at 4%, with a tolerance level stretching up to two percentage points on either side.

El Nino may not just pose the risk of fuelling inflation further it could also weigh on India’s economic growth, Das said. Geopolitical uncertainties, declining merchandise trading due to a contraction in global trade could also undermine growth, he flagged.

India's GDP growth could be above 7% for 2022-23, and that should not come as a surprise, the governor said.

India is expected to record a GDP growth of close to 6.5% in 2023-24, he added.

The RBI aims to stay prudent and act on time to ensure financial stability, remain proactive in foreign exchange management, and focus on keeping the rupee stable, Das said.

The central bank is not targetting at the "internationalisation" of the rupee, but it is an ongoing process, the governor said, adding that the RBI is still working on it.

Seventeen banks have opened 65 special vostro accounts to facilitate foreign trade in rupee, Das said. A vostro account is an account which a local correspondent bank holds on behalf of a foreign bank.

The RBI has also permitted 18 countries to have trade settlement accounts, Das added.

(Reporting by Nikunj Ohri in New Delhi, writing by Siddhi Nayak in Mumbai; Editing by Sonia Cheema and Dhanya Ann Thoppil)