Iceland’s central bank kept borrowing costs unchanged at a 14-year high for a second meeting as the risk of a volcanic eruption hangs over the already cooling Atlantic economy.

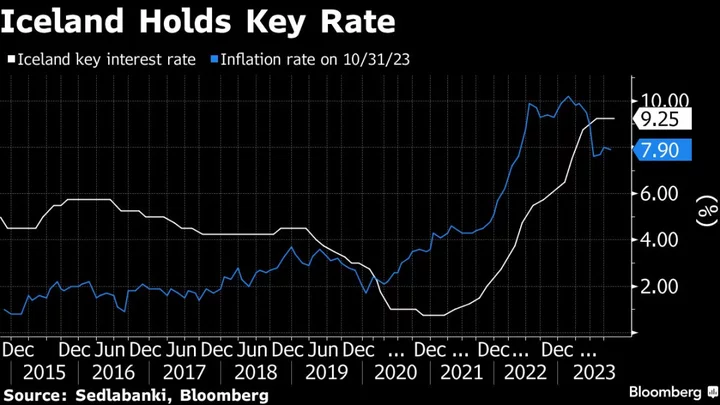

The Monetary Policy Committee in Reykjavik left the 7-day term deposit rate on Wednesday at 9.25% — the highest level in western Europe — as expected in a survey of market participants.

Policymakers warned it may “prove necessary to tighten the monetary stance still further” given a deteriorating inflation outlook, even as the impact of two and a half years of tightening is starting to show more clearly. They also cited concerns about the economic impact of seismic activity on the Reykjanes peninsula for the decision to keep rates steady on Wednesday.

“The uncertainty regarding seismic developments outweigh the conventional status check on the domestic economy, inflation movements, and the inflation outlook,” said Bergthora Baldursdottir, an economist with Islandsbanki hf. “Volcanic activity disrupting travel to and from the country could result in a shock for the tourism sector although we do not foresee it to continue for an extended period.”

For the past month, the island nation has been waiting for a volcanic eruption to happen in the region close to the capital, with thousands of tremors already wrecking infrastructure. The added uncertainty has complicated the job for policymakers as the inflation rate remains stubbornly high. The krona, which has lost 3.8% against the euro since the reports of seismic activity began last month, is also feeding imported price growth.

Last week’s emergency evacuation of fishing town Grindavik, home to around 3,700 people or about 1% of the Icelandic population, has highlighted the risks for the economy. A large-scale eruption could have considerable effects on the country’s biggest export sector, tourism.

Read More: Why Iceland Is So Worried About a Volcanic Eruption: QuickTake

Still, the central bank slightly raised its growth forecast for this year to 3.7%, while keeping next year’s estimate at 2.6%. Inflation “looks set to hold broadly unchanged for the rest of the year and fall more slowly in 2024 than previously expected,” the bank said, predicting next year’s consumer price growth at 5.7%. Inflation isn’t seen reaching the policymakers’ target of 2.5% within the forecast horizon ending 2026.

Housing prices in the capital area rose for a third straight month in October, reaching a record, according to data published Tuesday by the country’s housing and infrastructure agency. Prices have surged by a third since the central bank started tightening in May 2021, including a 2.9% gain over the past 12 months.

Another factor complicating policymakers’ battle against inflation is the upcoming round of wage talks regarding private sector contracts that will expire the beginning of 2024.

(Updates with details, comments from third paragraph.)