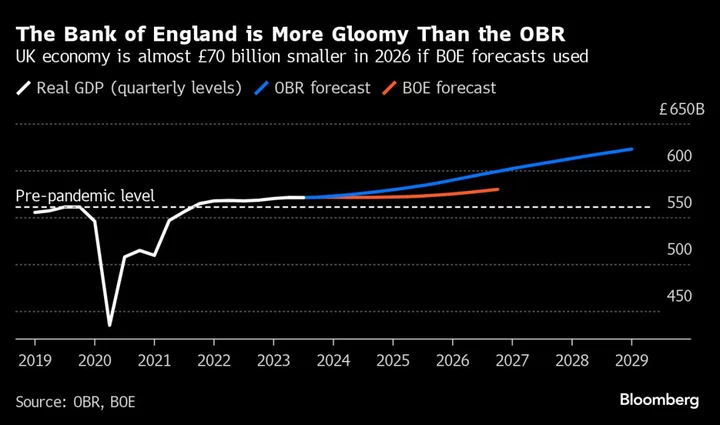

UK Chancellor of the Exchequer Jeremy Hunt would have had to raise taxes by as much as £20 billion ($25.2 billion) in the Autumn Statement had the Office for Budget Responsibility used the grim economic projections the Bank of England published just three weeks ago, according to a leading independent economist.

Ian Mulheirn, an associate at the Resolution Foundation and former chief economist at the Tony Blair Institute for Global Change, said it was striking that the BOE and the OBR, the UK’s two most important forecasting bodies, came to such wildly different judgments on the speed limit of the economy within the same month.

He said the differences may reflect biases that suit each institution’s objectives. A weak forecast for trend growth helps the BOE “sound tough on inflation” so it “retrofits a pessimistic view,” Mulheirn said. “The OBR on the other hand doesn’t want to trigger an unnecessary round of austerity. So it retrofits an optimistic view.”

On Wednesday, the chancellor announced £21 billion of business and personal tax cuts after the OBR forecast that the economy’s potential growth rate, the speed limit beyond which growth turns into inflation, averages around 1.6% over five years.

The BOE, which publishes forecasts for three years and does not expect inflation to fall back from 4.6% to the 2% target until the end of 2025, has potential growth at just 0.75% next year rising to 1.25% “over the medium term.”

The projection helped the BOE push back against market expectations of interest rate cuts as even weak growth can be inflationary if the capacity of the economy is so poor. Mulheirn said that the OBR growth forecasts implied that interest rates could be cut from 5.25% to 4.25% with no risk of higher inflation.

Martin Beck, chief economic adviser to the EY Item Club, said Hunt’s £13 billion headroom against his fiscal rules would be wiped out if it was based on the more pessimistic BOE forecasts. However, he said the central bank is likely to be overly biased due to its aim of keeping inflation at 2% and the OBR was a more “neutral arbiter of the outlook.”

“The BOE is naturally more pessimistic because they’re more concerned about inflation and the trend growth affects that,” Beck said. “They’ve always got to err on the side of caution because their ultimate interest is in keeping inflation under control.”

The OBR’s own analysis of alternative scenarios shows that a half percent reduction in potential growth would result in £42 billion more borrowing than projected in the critical 2028-29 year, when Hunt’s main rule that debt must be falling as a share of GDP bites. Under the OBR’s “productivity downside” scenario, the rule is broken as debt rises in every year of the forecast.

Mulheirn said the BOE’s outlook is even worse than the OBR’s downside scenario. Borrowing would rise by at least £50 billion, implying that the chancellor would have had to scrap both his £21 billion tax cut and raise £20 billion more from taxes or austerity on public spending to meet his rule with the same headroom.

Writing on X, the site formerly known as Twitter, Mulheirn said about the different projections: “Maybe these are genuine differences of judgement - but biases presumably play a role.”