HSBC Holdings Plc told brokers it will raise prices on UK residential and buy-to-let mortgages starting Thursday, its second increase in under a week.

The bank said in an email that it will remove its current new business residential products from sale via brokers at 5 p.m. local time on Wednesday “in order to maintain service levels.” The changes will affect certain two-, three- and five-year fixed products.

“We’re firmly focused on supporting customers through current pressures and providing access to good deals,” a representative for HSBC said in an email. But since the cost of funds has increased in recent days, “we have had to reflect that in our mortgage rates” like other banks, the lender said.

HSBC said it was withdrawing other new business products offered via broker services last Thursday. The pressure is building fast amid a fresh jump in mortgage rates and a rush by lenders to pull products as bond yields rise to levels last seen in 2008. On Monday, Banco Santander SA paused some mortgage deals for new borrowers, while NatWest Group Plc increased prices.

Coventry Building Society also told brokers it would pull products at 8 p.m. local time on Thursday and relaunch them at increased rates on Friday morning. The products include residential and buy-to-let offerings, Coventry said in an email.

Read more: Surging Mortgage Costs Push UK Housing Market to Breaking Point

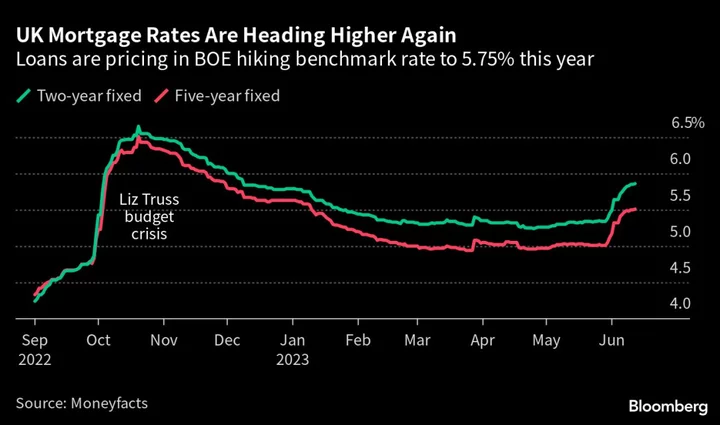

The average UK two-year fixed-rate mortgage was 5.9% on Wednesday, according to Moneyfacts Group Plc. That’s the highest since December, when rates were easing back after an ill-fated government budget fueled a market meltdown.

On top of that, faster-than-expected wage growth on Tuesday pushed traders to ramp up bets on future BOE hikes. Now, all eyes are turning to a crucial moment next week, when inflation figures and a Bank of England policy decision could combine to set the scene for larger house price declines.