Colorado drivers bought 9,446 electric vehicles in the most recent quarter, but Carrie Atiyeh is particularly psyched about 45 of them.

Atiyeh, associate director of transportation fuels and technology at the Colorado Energy Office, is one of the architects of the state’s Vehicle Exchange Program, which hands out a rebate of up to $6,000 to anyone who buys a new EV while surrendering a combustion-engine car. The program, which launched in late August, saw 45 people cash in a clunker by the end of September.

Scrappage policies like Colorado’s are gaining traction in the US as a two-for-one carbon bargain, a tidy way to catalyze clean car purchases while canceling out some of the least efficient machines. Vermont authorized a scrappage program in 2021; California did in 2014. In all three states, policymakers have mobilized around a simple calculation: If governments are going to dole out money to boost EV adoption, why not tie it to getting rid of gas guzzlers?

“It’s a really cool kind of holistic approach to getting these high-emission vehicles off the road,” Atiyeh says.

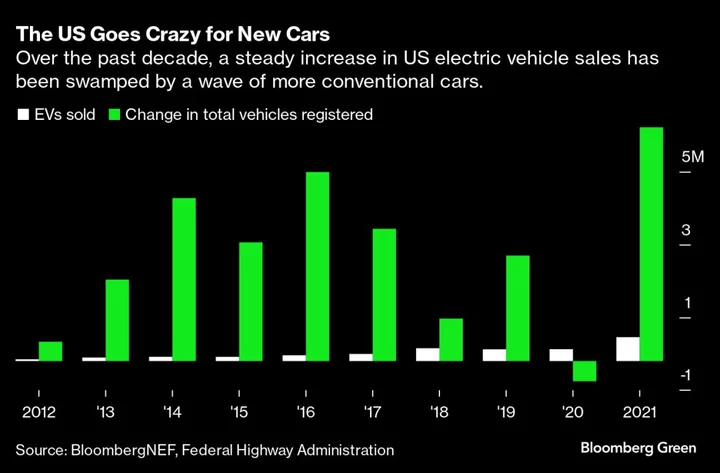

The timing of such programs is propitious, as high prices hamstring widespread EV adoption. The US also has more vehicles to scrap than ever. Between 2011 and 2021, the number of registered vehicles in the country surged to 282 million, an increase of almost 12%. Over the same time period, licensed drivers rose 10%.

Part of that disconnect is simple: Americans like buying new cars, particularly when there’s a strong economy and one of the strongest labor markets in history. Almost 28 million US households now own three or more vehicles, a 16% increase from five years ago.

But the long tail of US auto ownership is also extending. Over the past 10 years, the average age of a car on the road rose 9% to 12.2 years. For every silent new Tesla getting tucked into a garage, there’s a wheezing Ford Explorer rolling off the used car lot, or a geriatric Hummer finding a second home via Facebook Marketplace.

In other words, the clunkers are dying hard. That threatens to slow the time it will take for the US to electrify its entire fleet, especially since the newest gas cars are some of the most reliable.

Scrappage programs address some of these dynamics head-on. In Vermont, a surrendered clunker fetches $5,000 that can be used to buy a new or used electric vehicle, including bicycles and motorcycles. The funds can also be loaded onto a prepaid debit card to pay for public transportation or car-sharing services.

California has a similar system, paying up to $9,500 for those buying an EV and up to $7,500 for those switching to ride-sharing or public transportation. In the past fiscal year, the state set aside $245 million for the program.

In Colorado, the policy is funded in part by carbon emissions: The rebate money comes from a new fee on Amazon purchases and other household deliveries (28 cents per dropoff). The clunkers go to a nonprofit that breaks them down to recycled scrap and pours the proceeds into scholarships to train car mechanics.

In the market for a new EV? Use Bloomberg Green’s Electric Car Ratings to compare cars by price, range, battery size and charging speed.

Eric Hartman, a retired pilot in Lakewood, Colorado, junked his 2003 diesel Volkswagen Jetta in September in exchange for a rebate on a new Hyundai Kona electric. To qualify, the car needed to be more than 12 years old or have failed an emissions test.

“I really couldn’t afford a new car without some help,” Hartman says. “And now I don’t have to worry about shoveling a defective car off on someone else. It just worked out great.”

Had Hartman bought an internal-combustion Kona, its lifetime greenhouse gas emissions would have been roughly double — the equivalent of 292 grams of carbon for every mile traveled, according to the Massachusetts Institute of Technology’s Trancik Lab.

“At any given point in time, you care about the composition of the fleet,” says Jessica Trancik, an MIT professor whose work focuses on auto emissions and carbon-cutting energy solutions. “Funding programs that would help turn over the fleet more rapidly, makes a lot of sense.”

All about the fleet

Auto scrappage schemes are nothing new. They proliferated in Europe during the 2009 recession as a tool for stimulating spending and juicing regional carmakers. (One of the most generous programs, in Romania, was simply called “Rabla” — the wreck.) Germany’s scrappage program, established in 2009, was funded with €1.5 billion that was later increased to €5 billion.

In the US, a “Cash for Clunkers” program — formally known as the Car Allowance Rebate System, or CARS — scrapped 677,000 vehicles between July and August of 2009. Although post-mortems on the program have been mixed, Cash for Clunkers managed to trim .4% of the annual emissions from US vehicles, according to one study.

To be sure, EVs are already starting to take over dirty driving in the US: Nearly 8% of new car sales were electric in the third quarter, compared with 6.1% in the year-earlier period.

But affordability remains an issue. That means electric models are often purchased by the affluent, who tend to use them as second or even third cars. In a recent Bloomberg Green survey, 14% of EV drivers said they owned more than one battery-powered vehicle, and 6% of those surveyed had three or more. Each successive car in a household tends to be driven less, effectively watering down the decarbonization clout of an ancillary EV.

It’s a paradox in the US market — high prices limit EV adoption to the cohort least likely to reduce emissions — that scrappage programs are well-suited to combat. In the US, every state program is tied to a specific income threshold. In Vermont, those making more than 80% of the state median income are ineligible. Colorado applies the same threshold based on county.

“It was conceived as a way of accelerating fleet turnover, which is one of the biggest constraints to hitting our climate targets,” says Patrick Murphy, sustainability and innovations project manager at the Vermont’s Agency of Transportation. “But it’s not just an environmental program; it’s a social program.”

State-scrappage incentives can also typically be stacked on top of other incentives, including subsidies from the federal government and local utilities. A handful of American-made EVs are eligible for a $7,500 Inflation Reduction Act rebate, too.

After combining his own state rebate with another $5,500 in incentives from his local utility, Hartman paid just $21,500 for his Kona electric. The gas-powered version starts at $24,100.

An equity policy

Scrappage programs do have some hurdles of their own, including consumer uptake. In the two years since Vermont started its program, the state has retired just 50 gas guzzlers. Murphy attributes the slow pace to both limited marketing and a Covid-induced spike in used car prices.

“For the most part, these cars have to be drivable,” he says. “People who would ordinarily benefit from the program were seeing their pretty beat-up vehicles still going for $3,500, $4,000.”

The programs can also face funding constraints. A recent scrappage scheme in France was siphoned dry in two months (during which it managed to retire 20,000 inefficient vehicles). And even after Germany boosted its scrappage allocation to €5 billion, that program also ran out of cash months ahead of schedule.

Colorado’s policy has enough money for up to 500 clunkers a year — an easy target if the pace of applications continues, but a drop in the bucket when it comes to the state’s 5 million registered vehicles. California scrapped almost 45,000 cars in the past two fiscal years, but that was far short of the number of applications it received.

Nick Nigro, founder of Atlas Public Policy, an EV-focused consultancy in Washington DC, says scale is why his company focuses on measures like improved charging infrastructure and a federal incentive for buyers of used EVs. “For me, [scrappage is] not really a climate policy unless you’re willing to do it for millions of people,” he says. “I think it’s more of an equity policy.”

Colorado certainly views its clunkers program that way, but the state also sees it as a valuable strategy for meeting a mandate to cut emissions 26% by 2025 and 50% by 2030. In Denver and other urban areas, drivers are already encouraged to leave their gas-burning cars parked during smoggy “ozone” days, when public transportation fees are waived to encourage use. There have been 38 ozone days so far this year.

The state also lets buyers combine its scrappage cash with other rebates, credit-stacking that can quickly add up. Between federal, state and local-utility incentives, a Denver household making less than $62,500 a year — at least, one with a skill for paperwork — could get up to $19,000 for swapping a clunker for a new electric vehicle. That’s just $7,500 shy of the price of a new Chevrolet Bolt.

“We certainly want the cost aspect to not be a barrier,” Atiyeh says. “But we really want those high-emitting vehicles off the road.”

Are you planning to do more green investing or put more money into fossil fuels next year? Share your views in Bloomberg's latest MLIV Pulse survey.