This is one of the stories in Akshat Rathi’s new book Climate Capitalism, which is out today. Akshat explains the origin of China’s dominance in the battery market through the lens of CATL, now the world’s largest battery company. This is an adapted excerpt from the book.

It was an admission of defeat. But you would never know it looking at the mild-mannered smiles that morning. Angela Merkel, then German chancellor, was standing next to Chinese Premier Li Keqiang. On a partially cloudy summer morning in Berlin in July 2018, both leaders made small talk in between posing for the cameras.

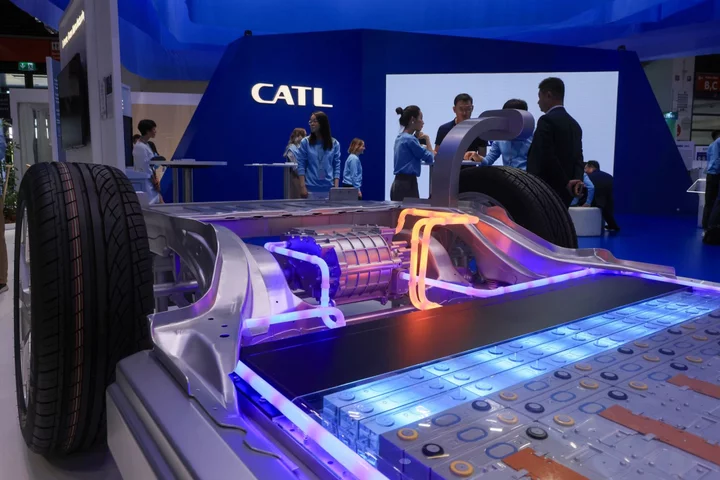

A few feet in front of them, two men in dark suits sat at a desk with identical leather-bound folders open and pens in hand. Then, with the blessing of the elders standing behind, Zeng Yuqun, CEO of Contemporary Amperex Technology Limited, the world’s largest battery company, and Wolfgang Tiefensee, a minister for the German state of Thuringia, signed an agreement committing the Chinese manufacturing giant to building Germany’s first large electric car battery factory. The moment passed quickly, and few of those present realized the historical importance.

Germany is known as the home of the car industry and with good reason. It is where, in 1879, Karl Benz built and ran one of the first internal combustion engines designed to power a car. Today, it is home to Volkswagen, one of the world’s largest car companies, and other brands such as BMW, Audi, Mercedes-Benz and Porsche, which are recognized globally for their excellence. By one estimate, the car industry accounts for a seventh of Germany’s jobs, a fifth of its exports and a third of its research spending.

The agreement was an acknowledgement that the industry, which had been the country’s economic backbone, had finally failed. Not because it couldn’t make cars that people wanted, but because it hadn’t developed a crucial technology – lithium-ion batteries – that would power them in the 21st century. While countries are finally seriously trying to catch up, China has taken a commanding lead. By 2025, China’s battery production capacity will be three times as much as the rest of the world combined, according to BloombergNEF estimates.

It wasn’t just the Europeans that missed the boat. Even as recently as the late 1990s or early 2000s, few were sure that batteries could do so much and at such low costs. China’s rise as the global leader of lithium-ion batteries is now a matter of regret for the oil industry, which invented them; for the Americans, who nurtured the technology towards commercialization; and for the Japanese, who were the first to scale up the technology. So I traveled to China to find out the story of how that happened.

The first thing I noticed when I walked into CATL vice chairman Huang Shilin’s twentieth-floor office was the view. It was a grey November afternoon in 2018, and a thick fog rolled over the mountains in front of us, revealing a bay that opens into the East China Sea. Huang, who is Zeng’s second-in-command at CATL and one of China’s richest men, and I admired the view for a little bit, but I was eager to ask him questions. He handed me a cup of hot water and we talked batteries – a 200-year-old invention.

A battery, technically, is any device that converts chemical energy to electrical energy. While the first one was a rudimentary example invented by Italian chemist Alessandro Volta in 1799, it wasn’t until 60 years later – when the lead-acid chemistry was born – that batteries could be put to work beyond single use. By the end of the 19th century lead-acid batteries were deployed on a mass scale, including to power early cars – although this was short lived. The battery chemistry couldn’t compete with the distances that could be covered in a car that burned fossil fuel. The rebirth of the electric car had to wait until the invention of lithium-ion batteries.

During the oil crises of the 1970s big fossil fuel companies were reminded that oil is a finite commodity, and so they doubled down on efforts to find alternatives. One project, helmed by chemist Stanley Whittingham at the US oil giant Exxon, led to the invention of the world’s first rechargeable lithium-ion battery: one of its electrodes – the cathode – was titanium sulfide and another – the anode – was lithium metal. But there was a major problem that needed fixing: the battery kept bursting into flames.

Before Whittingham was able to do anything about that, the 1980s rolled around, the oil glut returned, and Exxon’s interest in finding alternatives waned. Fortunately, his work had sparked broader interest in the field. Over the next decade lithium-ion batteries were the subject of intense scientific work around the world. Three researchers provided the upgrades that transformed Whittingham’s invention into a viable commercial product (and for that they were awarded the 2019 Nobel Prize in chemistry).

In 1992 Sony became the first company to commercialize the lithium-ion battery as an optional upgrade for its Handycam. Others were quick to jump on Sony’s success, including Zeng Yuqun, who, at the age of 31, founded Amperex Technology Limited, or ATL, in 1999. Within two years ATL had produced lithium-ion batteries for 1 million devices and made its name as a reliable supplier. In 2005 ATL was acquired by TDK, the Japanese firm probably best known for its cassette tapes and recordable CDs.

Zeng and Huang decided to stay on after the acquisition. TDK added Japanese discipline to ATL’s manufacturing process and grew its lithium-ion battery business into the newest cash cow: the smartphone market. Soon ATL would go on to supply batteries to both Samsung and Apple.

Huang began fielding queries about batteries for electric cars as early as 2006. The earliest request came from Reva, an Indian company. At the time it was making the G-Wiz, a two-seater electric car powered by improved lead-acid batteries. Its top speed was 40 kmph (25 mph) and range 80 km, with only slow charging. Lithium-ion batteries would increase the Reva car’s speed and range, and enable faster charging. In order to develop a solution, Huang and Zeng created a research department within ATL while simultaneously starting to acquire technology licenses from the US that would enable them to build off existing research.

Few Chinese companies at the time were buying up licenses or investing millions of dollars into early stage car battery research in this way. Chinese companies have been accused of stealing or copying from foreign firms. But with its own robust research efforts, ATL broke that mold, and set the stage for Chinese domination of what will be one of the most important sectors of manufacturing in the 21st century.

By 2008 ATL already had something to show for its efforts. That year, the Chinese government rolled out a demo fleet of electric buses at the Beijing Olympics – some of which were powered by ATL batteries. The electric bus demo fleet was the start of the government’s plan to push for the electrification of transport, a move that would cut deadly particulate pollution, reduce oil imports and lower greenhouse gas emissions by reducing the number of pollution-belching buses. The Chinese government was under pressure from citizens and the global media to do something about its smoggy skies and to lower its carbon footprint. Huang and Zeng sensed an opportunity. In 2011 they created the spin-out company CATL, C standing for Contemporary to denote their belief that the future of batteries lay in the car business.

About the same time, in a bid to capitalize on a next generation technology, the Chinese government introduced subsidies for electric cars. The catch was that to be eligible the battery had to be Chinese-made. That’s when BMW, which was looking to grow its presence in China, partnered with Chinese car maker Brilliance and CATL. In 2013 BMW-Brilliance launched the all-electric Zinoro for the Chinese market. It was based on the design of BMW’s X1 and used CATL batteries.

Unlike AA batteries, which are essentially the same no matter who makes them, electric car batteries need to be typically custom-made for different car models, to fit the body of the car in the most optimal way possible. That means engineers from the car maker need to work with those from the battery company, exchanging ideas, standards and processes. While working with BMW on Zinoro, CATL added some German engineering skills, such as attention to detail and increasing the reliability of products coming off the factory floor.

“We have learned a lot from BMW, and now we have become one of the top battery manufacturers globally,” Zeng said at an event celebrating Zinoro in 2017. “The high standards and demands from BMW have helped us to grow fast.” In 2019, CATL would break ground on Germany’s first car battery factory, beating the revered German car industry to the punch. Today the Chinese giant also has a plant in Hungary, with plans to build new ones in the US and Mexico. It supplies batteries to every electric vehicle manufacturer, including Tesla.

Akshat Rathi’s book, Climate Capitalism , is out now.