Hospitals are returning to the municipal-bond market after shying away since the pandemic.

The sector is now “through the trough” financially, said Matt Cahill, an analyst at Moody’s Investors Service, which upgraded its outlook for not-for-profit hospitals to stable earlier this month, citing moderating expenses and increasing revenues as patients return for treatment.

“There are health systems from different parts of the country working on deals,” said Daniel Steingart, a vice president at Moody’s, adding that he’s seeing appetite for borrowing return.

Read More from Bloomberg Intelligence: Health Care Looks to Finally Put Pandemic Pain in the Past

At least four hospitals plan to borrow in the coming weeks, according to preliminary bond documents posted to MuniOS, an online repository. They include $273 million of debt for a new hospital for Riverside Health System in eastern Virginia, a $400 million bond sale for a medical-records system at Beth Israel Lahey Health in Massachusetts, and $28 million of bonds and $46 million of debt to replace hospitals in rural Louisiana and Montana, respectively.

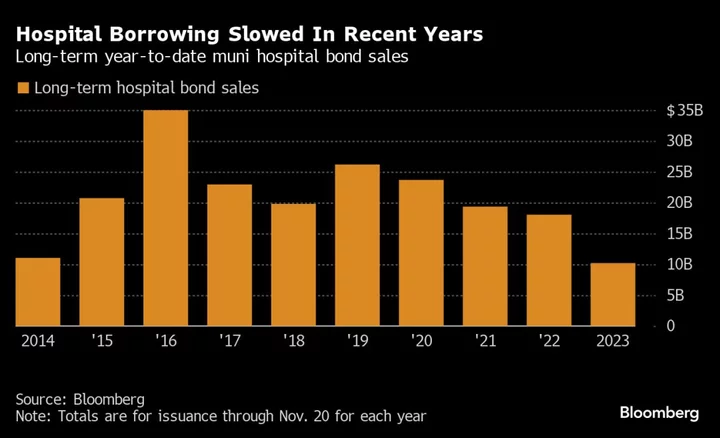

Hospitals held off on projects like renovations as they coped with the upheaval of the pandemic, including spiking expenses, staffing shortages and a slowdown in elective procedures. Long-term muni debt issued for hospitals fell about 44% from a year ago, compared to a 3% decline for the broader muni market, according to data compiled to Bloomberg.

“Organizations want to spend again,” Cahill said. In fast-growing areas like Texas and Florida, “you’re almost forced to” maintain market share.

Borrowers are taking advantage of falling yields and signs that point to a pause in further interest rate hikes, said Jonathan Mondillo, head of North American fixed income at Abrdn, who is bullish on the hospital sector, citing its role as an essential-service provider. Ten-year benchmark municipal-bond yields are down 67 basis points this month.

“Wage pressures, staffing issues and inflation have started to ease, and profit margins and patient volumes have rebounded,” he said. “Although we expect profitability to remain below pre-Covid level through the coming years, we feel things will continue to improve.”

The general municipal bond index has gained about 4.4% so far this month, while hospital bonds are up 5.5% over that same period, according to data compiled by Bloomberg.

‘Best Foot Forward’

In Virginia, Riverside plans to use proceeds of its bond sale, set to price on Nov. 29, to build a new 50-bed hospital in Isle of Wight. The system’s main medical center about 20 miles from the new site operates at capacity daily, according to Riverside’s CEO and President Dr. Michael Dacey.

“Certainly interest rates are higher, certainly margins are less, although we’re still doing well,” Dacey said in an interview. “At times like this, you really have an obligation to take risks.”

That said, he doesn’t see the pressures on the sector abating anytime soon, including higher construction costs. Because of that, Riverside plans to cut about $75 million annually in non-labor expenses through the end of the next fiscal year.

“When you’re going out to sell bonds, you want to put your best foot forward,” Moody’s Steingart said. “If you can wait a year and get your margins a little higher, be more stable and present a better story to investors, I think on balance, that’s what most organizations are doing.”

(Adds additional example at end of fourth paragraph. Earlier version corrected location of new Riverside Health System hospital in 11th paragraph.)

Author: Lauren Coleman-Lochner