Hong Kong, which is preparing to introduce a new regime for trading digital assets, is responding to concerns raised by industry players about the shortage of a crucial type of worker.

In conclusions from a weeks-long consultation published Tuesday, the Securities and Futures Commission included a provision that may allow licensed crypto platforms to employ fewer so-called responsible officers than previously thought.

The difficulty finding responsible officers, or ROs, had emerged as a hurdle for crypto companies seeking permits under Hong Kong’s new regulatory regime, which takes effect June 1. That’s threatening to set back Hong Kong’s push to establish itself as a crypto hub, a key part of the city’s effort to recover from the twin blows of political unrest and unpopular Covid restrictions.

“It’s the hardest position to fill in Hong Kong right now,” Lily King, chief operating officer of Cobo, a digital-asset custodian which is applying for a Hong Kong license, said before the SFC’s announcement. “There aren’t enough ROs in the market.”

RO System

ROs are a feature of Hong Kong’s broader regulatory system for financial services. The RO arrangement, which requires a firm to have two such executives for each type of license it holds, is also being used for the framework for digital assets.

Aside from a permit to provide automated trading services, a crypto exchange might also need licenses for dealing in and advising on securities, as well as for managing assets, depending on the scope of its operations.

Executives acting as ROs must be licensed by the SFC and have relevant experience and product knowledge for the type of permit they hold. They are responsible for ensuring their companies comply with rules, and can be subject to civil and criminal penalties in the event of a breach.

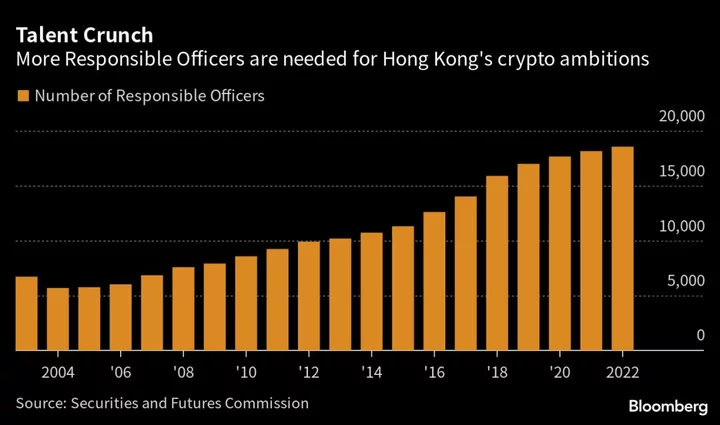

There are about 18,000 ROs in Hong Kong, holding licenses ranging from asset management to trading and corporate finance. However, only 95 have the Type 7 license for providing automated trading services, a key one for crypto exchanges.

Digital-asset ROs also need experience in areas such as blockchain technology, further narrowing the field of suitable candidates.

Seeking to ease some pressure on crypto firms, the SFC said Tuesday that it may approve one single individual as RO under both securities and anti-money laundering ordinances. That would allow a virtual-asset trading platform to employ fewer such workers during the transition to the new regime, according to the regulator.

“As there may be a lack of talent with both virtual asset and traditional securities experience, we are prepared to adopt a pragmatic approach,” the SFC said, adding that it will provide more details later.

The regulator is processing three to four applications from crypto exchanges under the old regime and has received indications of interest from over five more for the new one, Chief Executive Officer Julia Leung said in an interview in late April. Huobi Global, OKX and Gate.io are among companies that have publicly said they plan to apply.

Salary Premium

Hong Kong has just two crypto exchanges licensed under its previous “opt-in” regulatory system for digital assets, so new entrants are mostly left to target ROs working in traditional finance. Yet those workers are typically reluctant to switch to crypto because it’s viewed as a riskier career path, so “more incentives need to be offered to them,” said Cobo’s King.

Because of the limited supply, ROs with crypto experience command up to 20% more in compensation than those in traditional finance — with salaries reaching as high as HK$150,000 ($19,138) a month, according to Daniel Lam, the founder of recruitment company Crypto Connect.

“In terms of the severity of the issue on a scale of one to 10, I think we’re at seven to eight right now,” said Jon Pham, a managing director at ZhongYi Investment Managers Limited, a legal and regulatory consultant that has advised more than a dozen crypto companies applying for a license in Hong Kong. It typically takes up to five months to hire for an RO position in crypto, he estimated.

One way Hong Kong has tried to address the shortage is by allowing people with strong technical backgrounds in crypto and blockchain to become ROs, even if they lack the purely financial qualifications, Leung said in the April interview. “We want techie people who know the blockchain,” she said.

A technically adept RO must still partner with a peer with relevant financial experience, according to an SFC circular.

The city also faces one potential hurdle to luring people accustomed to the work-from-anywhere ethos of the crypto world: at least one RO must be present at all times in Hong Kong to supervise the licensed business, according to local securities law.