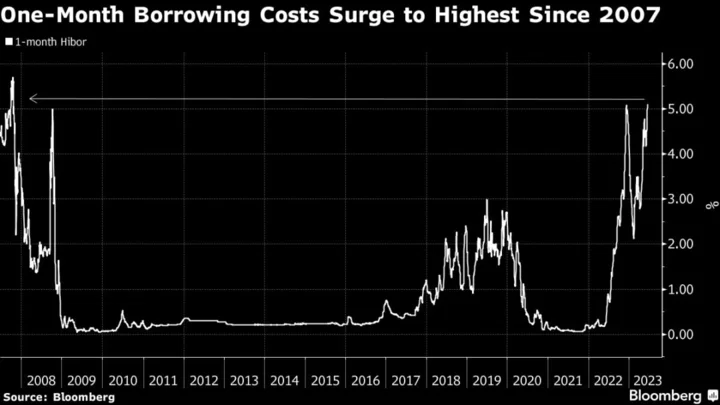

The cost for banks to borrow Hong Kong dollars from each other for a month rose to the highest level since 2007 after prolonged currency intervention shrank the city’s liquidity pool and demand for cash climbed toward quarter-end.

The one-month Hong Kong interbank offered rate for the local currency — known as Hibor — increased eight basis points to 5.10%, having more than doubled from this year’s low set in February. The gauge’s discount to the US dollar interbank rate has now almost vanished, making the once popular bearish-Hong Kong dollar strategy less appealing.

While higher funding costs will help Hong Kong authorities curb bearish bets on the city’s currency and maintain its peg to the dollar, a sustained increase may threaten the nascent economic recovery. The one-month tenor of Hibor is a reference rate for mortgage loans, so a further advance may pose a risk to the property sector.

Hong Kong dollar Hibor has become more volatile this year as the authorities have spent about $6.5 billion in currency intervention since February, reducing a gauge of interbank liquidity known as the aggregate balance to the lowest since 2008.

“Given the current low level of the aggregate balance, there will likely be visible signs of Hong Kong dollar funding tightness around June-end,” said Duncan Tan, a rates strategist at DBS Bank Ltd. in Singapore. “The increase in short-term bank settlement needs could be tied to higher trading volumes of Hong Kong-listed equities and more dividend payments around this time of the year.”

The challenge for the authorities began when US money-market rates surged above their Hong Kong equivalents, luring hedge funds to profit on the difference. The spread between the two became wide enough for funds to borrow Hong Kong dollars cheaply and buy the higher-yielding greenback.

The popular trading strategy helped push the local currency to the weaker end of its 7.75-7.85 peg with its US counterpart, triggering the need for official intervention. The Hong Kong dollar dropped 0.1% to 7.8213 per dollar Tuesday morning.