It’s hard to pass up a good rally in US leveraged finance markets, particularly if you’re a bank with a bunch of debt that’s been stuck on the balance sheet for months.

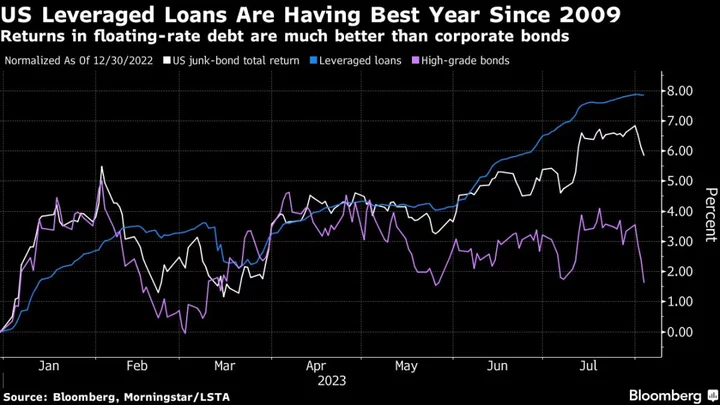

As the risk of a severe recession lessens while the supply of new debt has stayed relatively low, money managers are hunting for opportunities to put dollars to work. That’s pushed secondary leveraged loan prices near highs not seen in months as investors flush with cash seek out supply, leading borrowers to stream into both loan and junk bond markets with opportunistic deals in recent weeks.

Banks led by Citigroup Inc. and Bank of America Corp. are also capitalizing on the demand by trying to finally offload some of the debt for Apollo Global Management Inc.’s buyout of Tenneco Inc. last year. The syndication will kick off on Aug. 7, Bloomberg News reported.

“In general, both high yield and loan markets have had anemic supply recently,” said Darpan Harar, portfolio manager for multi asset credit funds at Ninety One, a global asset manager. As a result, appetite for riskier deals has improved in the US and Europe, he said.

That kind of window may bode well for Tenneco, which was last rated B by S&P Global Ratings, citing an increase in leverage following the buyout by Apollo. After an earlier attempt to offload some of the credit faltered, terms on the debt now limit the ability of the borrower to carve out valuable assets, making it more attractive to investors, Bloomberg reported on Aug. 2.

Underwriters failed to sell portions of the $5.4 billion Tenneco financing previously because investors were fleeing risky assets in the wake of the Federal Reserve’s interest rate hikes. Even steep discounts for the planned $1.4 billion leveraged loan and $1 billion junk bond weren’t enough to attract debt buyers at the time.

In Europe, banks have also been dealing with billions in hung debt, much of which they managed to rid themselves of by the end of the second quarter, albeit at huge losses.

Tenneco was among many high-profile buyouts underwritten before credit markets turned, creating a pile of more than $40 billion of debt that lingered on the books of Wall Street banks for months. Lenders have since offloaded debt related to several deals including Citrix Systems Inc. and Nielsen Holdings.

What’s left in the US market? About $23 billion led largely by debt from the buyouts of Twitter Inc. — which has now been renamed X — as well as Tenneco and Brightspeed, according to data compiled by Bloomberg. Their debt was widely seen as harder to sell given performance, their industry and the macroeconomic backdrop.

If Tenneco’s deal goes well, bankers sitting on other hung debt will take notice. Still, it may be some time before the embattled Brightspeed, Apollo’s 2021 acquisition of phone-and-broadband assets, comes to market. Existing creditors have sued, claiming Apollo illegally structured the new debt to override their priority for repayment.

As for X, investors are more likely to wait and watch how the company performs under Elon Musk’s vision to transform it into “the everything app.”

Week in Review

- Fitch Ratings’ downgrade of US government debt added to a shaky week in global markets and drove measures of credit risk higher.

- Since the fall of Silicon Valley Bank in March, US banks have pulled back on financing for small and midsize businesses as well as consumer credit companies — creating an opening for the new rising power on Wall Street: private credit funds.

- A group of private credit lenders led by Blue Owl Capital Inc. and Sixth Street Partners has agreed to provide a $2.65 billion debt package to support Francisco Partners and TPG Inc.’s acquisition of New Relic Inc.

- Vista Equity Partners is offering to pump $1 billion of preferred equity into its portfolio company Finastra Group Holdings Ltd. to get a refinancing over the line, in a package that also includes a $4.8 billion private credit loan.

- Blackstone Inc.-backed solar firm Esdec is tapping private credit lenders for a €600 million ($662 million) loan to help fund a shareholder payout.

- Apollo Global Management Inc. is seizing on an upturn in credit conditions to potentially bring Europe’s first collateralized loan obligation refinancing in more than a year.

- The collapse of trucking giant Yellow Corp. casts doubt on whether the US government will be able to fully recoup a controversial $700 million loan.

- Private equity giant KKR & Co. is poised to hand over embattled payments firm Unzer to a group of creditors.

- Beleaguered ed-tech firm Byju’s missed yet another target date set by its creditors to amend terms of a $1.2 billion debt.

- Country Garden Holdings Co., one of China’s major developers, scrapped a $300 million share placement, prompting its securities to slide in both equity and credit markets.

- Chinese state-backed developer Sino Ocean Group Holding Ltd. will get an extra 30 days for a 2 billion yuan bond payment, as the firm plans to curtail spending to avoid a possible default.

On the Move

- Robert W Baird & Co. Inc. has hired Will Zak, formerly a leading trader of non-agency structured products at Barclays Plc, to focus on structured specialty sales.

- BlackRock has recruited Varun Ahuja to lead its APAC (ex-China) credit research team. Ahuja previously worked as an executive director in Asia credit research at JPMorgan.

- Deutsche Bank named Adele Moon as DCM Head for South Korea as it expands investment banking capabilities and re-enters the local debt capital market after five years. Moon was previously Head of Korea DCM for Mizuho Securities Asia in Hong Kong.

- Asia-based asset manager Hillhouse has hired Srinivasulu Yanamandra for its private credit business. Yanamandra will join as a managing director in September, having previously been a managing director at Barclays.

--With assistance from Claire Ruckin and Fareed Sahloul.

Author: Jill R. Shah