Traders are ramping up protection against a surge in the yen as speculation remains alive that the Bank of Japan may tweak its ultra-loose monetary policy.

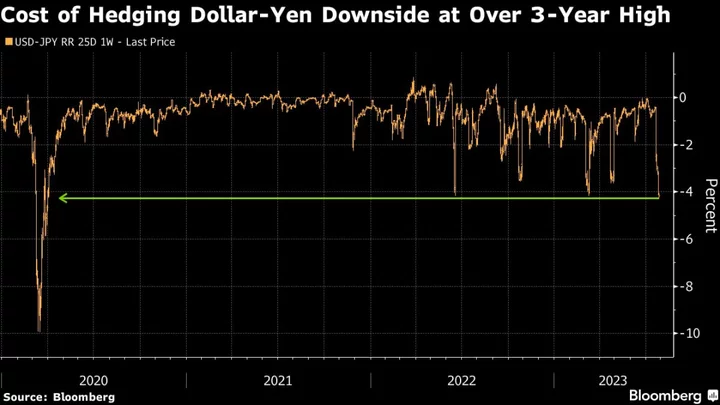

One-week risk-reversals for dollar-yen, a gauge that shows how much more traders are paying to hedge a rise in the yen than a fall over that time frame, have hit their highest level in over three years. That’s ahead of the BOJ’s policy decision Friday, which comes after the Federal Reserve raised interest rates by 25 basis points Wednesday, and left open the door to leaving them unchanged at its next meeting in September.

The signal from the options market shows how traders are nervous about the BOJ taking any steps to unwind its accommodative policy, a key driver behind the yen weakening to the lowest in almost eight months against the dollar. Traders remain on edge even after Governor Kazuo Ueda indicated he’ll stick with easing as Japan’s central bank is some way from hitting its inflation goal.

“Market participants feel the need to hedge against the yen’s appreciation, given that the BOJ is seen adjusting policy sooner rather than later,” said Jun Kato, chief market analyst at Shinkin Asset Management Co. in Tokyo.

The yen has had a bumpy ride this month, rebounding more than 5% versus the greenback from an eight-month low of 145.07 at the end of June before trimming about half of its gains on Ueda’s remarks last week. Japan’s currency was little changed at 140.20 against the dollar as of 10:22 a.m. in Tokyo on Thursday.

Still, central bank officials are said to be considering a sharp increase to their inflation forecast for this fiscal year, a move that will probably boost the chance of a policy tweak in coming meetings.

The International Monetary Fund said this week that inflation risks in the world’s third-largest economy are on the upside, and the BOJ needs to prepare itself for the need to start tightening.

“Even if the BOJ decides to stand pat as expected this week, other factors including the degree of upward revisions to the inflation outlook may strengthen the view of adjustments in coming meetings and may spur gains in the yen,” Shinkin Asset’s Kato said.

--With assistance from David Finnerty.