A leveraged trade in US Treasury futures that has become popular among hedge funds poses a risk to global financial stability, according to the Bank of England.

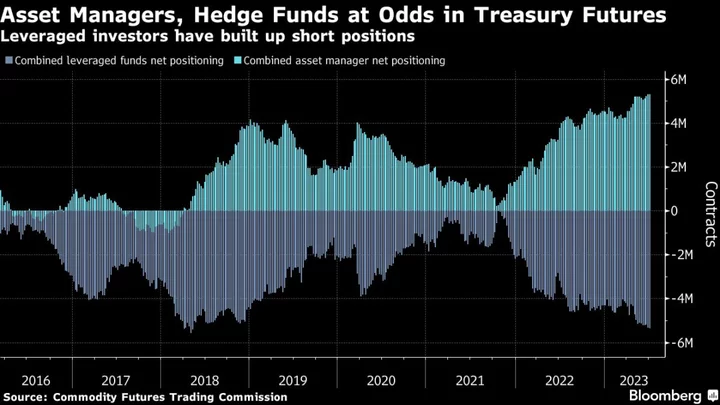

Short positions in Treasury futures by leveraged investors have increased in recent months, the central bank said in its Financial Stability Report Wednesday. Market intelligence suggests these bets are “relative to bonds or swaps” and if prices were to move sharply, deleveraging the positions could further amplify stress, it said.

Hedge funds often look to exploit the pricing difference between cash bonds and futures in a strategy known as the basis trade, and look to bolster their returns by borrowing money in the repo market. The bets tend to work well in a low volatility environment, but backfired in March 2020 when the pandemic triggered a stampede into US bond futures.

Such risks “remain largely unaddressed and could resurface rapidly,” the BOE said. “In particular, the sharp transition to higher interest rates and currently high volatility increases the likelihood that market-based finance vulnerabilities crystallize and pose risks to financial stability.”

Read more: Notorious Hedge Fund Trade Puts Bond Bulls on Steepening Watch

Recent Treasuries positioning suggests leveraged traders have kept adding to their basis trade bets, in part facilitated by asset managers who’ve piled into the other side of the wager to hedge their interest-rate exposure.

--With assistance from Ruth Carson.