Several hedge funds in Asia are starting to mimic global giants like Citadel and Millennium Management by charging clients additional fees to cover costs ranging from employee compensation to life insurance in a bid to lure top talent.

Nine Masts Capital Ltd. recently introduced the so-called expense pass-through model, while Southern Ridges Capital Pte embraced it last year. Pinpoint Asset Management Ltd. has created three new share classes using this structure, according to people familiar with the matter, and newsletters seen by Bloomberg News.

The model may translate into higher fees than the traditional performance and management charges even as many hedge funds in Asia post weak returns. Regional funds dropped another 1.8% this year, after an 8.8% average decline in 2022, the biggest drop since 2008, according to Eurekahedge Pte data. Global investors have cooled on hedge funds with significant China exposure amid geopolitical concerns and a sluggish economy.

Asia money managers said they need to pass on more costs to compete with global hedge funds such as Millennium that have been expanding in the region. Smaller funds using traditional fee models often find themselves outbid by international firms dangling multi-million-dollar signing bonuses. The fees also represent a stable source of revenue as traditional levies trend lower or are eliminated in volatile markets.

“Without a cost pass-through, there will be constraints on the ability to compensate portfolio managers in line with current market standards,” said Shawn Yuan, co-chief investment officer of Dymon Asia Capital SP Pte, which adopted pass-through. Portfolio managers are “easily poached” by firms with these models, he added.

The pass-through is a shift from the traditional “2 and 20” structure in which hedge funds charge 2% of client assets, along with a 20% cut of any profits. This newer structure was once the preserve of large multi-manager firms, whose long list of potential investors give them more bargaining power on fees.

Among other things, clients can be on the hook for expenses such as fitness plans for traders at Steve Cohen’s Point72 Asset Management, relocation expenses at Balyasny Asset Management, investment and litigation-related costs at Verition Fund Management and Millennium’s key-man life insurance on billionaire founder Izzy Englander, with the fund as beneficiary, according to client offering documents reviewed by Bloomberg News.

Multi-manager firms, with many passing on these fees, have expanded assets globally at an annual compound rate of 18% since 2017, versus low single-digit increases for the rest of the industry, according to reports from Goldman Sachs Group Inc.’s prime brokers. Even as staffing stagnated at rivals, those firms using a variety of portfolio managers have doubled headcount.

Proponents argue that pass-through is key for multi-manager firms with pods of investors where each one trades a sizable portion of the portfolio. One manager might make money, while others post losses, resulting in flat returns overall. Without an expense pass-through, the firm’s owner has to dip into management fees or their own pocket to reward the star, said one Singapore-based hedge fund executive who declined to be identified.

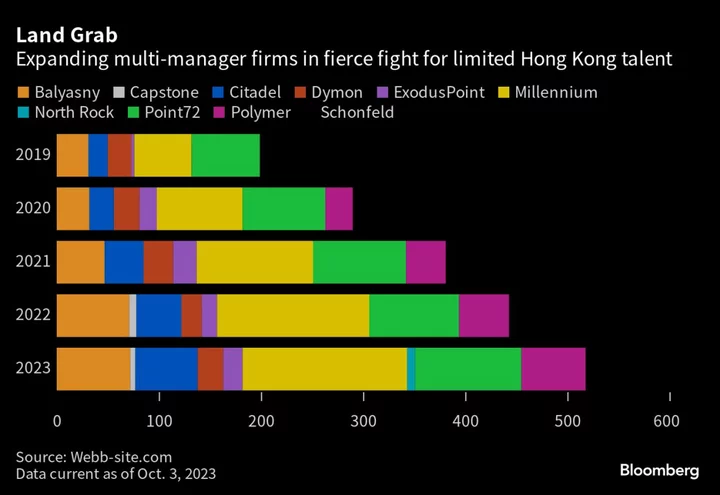

As of September, nine multi-manager firms had 507 employees licensed in Hong Kong, double the number from late 2019. Similar expansion has been afoot in Singapore and Tokyo, according to regulatory data. With that growth came higher pay, which is also driving some Asia funds to the new model, as million-dollar signing bonuses become more common.

Chris Gradel, chief executive officer of the PAG hedge fund firm, said several employees of its multi-strategy business were poached with “eight-figure” pay offers, which he described as absolute “insanity” at a recent conference in Hong Kong. PAG is a minority shareholder of Polymer Capital Management. Pinpoint managers Takehiko Asari and Raymond Choi decamped to Millennium last year, according to regulatory and LinkedIn data. Southern Ridges lost Charles Chung to Balyasny.

Further stoking pay pressure, the regional talent pool is dominated by longer-term stock pickers who lean heavily on bullish bets. That leaves multi-manager firms with a slimmer pool of professionals with skills to handle short bets or trade fixed income and currencies.

“You’ve got a smaller percentage of the candidate market who are a good fit” for a multi-strategy platform business, said Chris Corcoran, a senior manager of financial services at recruitment firm Robert Walters in Hong Kong.

Southern Ridges now charges for staff compensation, benefits, travel and entertainment in its newer macro fund, according to a regulatory filing. Pinpoint has lowered management or performance fees for investors who cover pass-through expenses for its investment team, according to a newsletter sent to investors and people familiar with the matter.

Dymon adopted this model after shifting from a macro trading firm to a multi-manager, multi-strategy fund that competes with the likes of Millennium and Point72. It caps pass-through costs at a level deemed reasonable by investors, Yuan said. The other firms declined to comment on the fee structure.

Outweigh Costs

Pass-through defenders say stronger, more stable returns can outweigh the costs. Multi-manager hedge funds with pass-through returned an average 10% since January 2018, versus 5.8% for those without, according to a Barclays Plc presentation in January.

“Care needs to be taken though to understand which expenses are being passed through, and to make sure that these are reasonable and in line with best practice,” said Patrick Ghali, managing partner of Sussex Partners, which helps clients pick hedge fund investments.

With investors now expecting higher returns because of rising global interest rates, not every firm can get away with increasing fees. Among the few Asia funds that have made the switch, several have posted decent performances. Nine Masts overcame a 2020 loss with an 8.5% return in the first nine months of 2023, and double-digit gains in the last two years, according to a document seen by Bloomberg News.

Southern Ridges’s newer macro fund wrapped up its first year with an 11% gain through September, said a person with knowledge of the matter. Pinpoint’s multi-strategy fund stayed positive in its first eight years, and dipped no more than 1.5% last year and in the first nine months of 2023, depending on share classes. Two of the new share types with pass-through have performed better than older ones, according to a newsletter.

“In the end, it always comes down to performance and scarcity of capacity,” said Ghali. “A manager with middling returns will find it very hard to change fee terms,” he added, while top-performing firms with more money coming in than they can accommodate will probably find it quite easy to do so.

(Adds more details about global funds’ pass-through expenses in seventh paragraph)