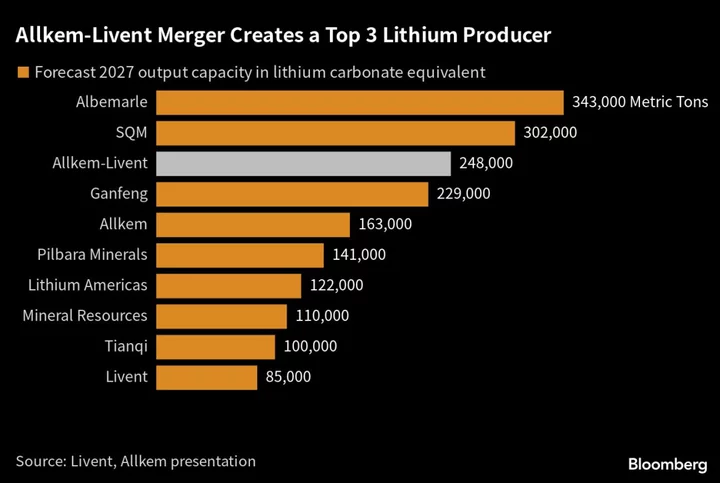

The chief executive of what will become the world’s third-biggest lithium producer says the new company will focus on building a supply chain in the Americas, as US automakers look for non-Chinese sources of the electric vehicle-battery metal.

“America-centric is a big differentiator for us with customers, with investors,” Paul Graves said in an interview Thursday, a day after it was announced Livent Corp. will combine with Allkem Ltd. to create a $10.6 billion company. China, where US-based Livent has refineries, “will not be a focus of growth for us in the future,” he said.

The as-yet unnamed company will bring together lithium assets from Argentina, Canada and Australia, allowing it to meet growing Western demand, Livent CEO Graves and his counterpart at Allkem, Martin Perez de Solay, emphasized in the joint interview.

President Joe Biden’s Inflation Reduction Act, which supports domestic production of EV components, had “turbocharged” the move away from China, Graves said. The law, enacted last August, offers tax credits on EVs that use materials made in the US or its free-trade partners, such as Canada and Australia.

The Livent-Allkem deal shows how the IRA is reshaping supply chains for metals like lithium, and how it’s helping Washington challenge Beijing’s leading role in many sectors that are critical to the energy transition. China is the dominant downstream producer of battery materials, and the only part of the lithium supply chain it doesn’t control is extraction, where Australia and Chile are important.

READ: Lithium Rivals Allkem and Livent Merge in $10.6 Billion Deal

“The growth area is really investing in Argentina, investing in Canada, investing in localized Western supply chains,” Graves said. Australia, a key ally of the US, would also be a focus for the new company, Perez de Solay added.

While Argentina doesn’t have an FTA with the US, Graves said he was hopeful the White House would make an exception.

“It’s in the US’s interest to qualify Argentina and we expect that they will,” he said, adding he was “getting a favorable response from the US government.”

The deal is due to be completed by year-end, with the new company to be listed in New York. Sydney-listed Allkem’s share price rose as much as 17% in trading Thursday, while Livent closed up 5.2% in the US on Wednesday.