Fund managers in India have been jumping into a “lucrative” arbitrage trade ahead of a mega-merger that will see the nation’s largest private sector lender HDFC Bank Ltd. absorb its parent Housing Development Finance Corp.

With the merger likely to be effective July 1, domestic equity mutual fund managers bought a net $570 million worth HDFC shares in May, the biggest monthly purchases since at least January 2016, according to Prime Database. At the same time, they sold HDFC Bank shares worth $370 million, the most since February 2017. The deal will unite the two companies that had a combined market value of about $173 billion as of Monday’s close.

READ: India Set for Finance Behemoth as HDFC Merger Nears

In a kind of “spread trade,” local funds have been buying parent HDFC shares as a way to reduce the cost of acquiring shares in HDFC Bank. Once the deal is complete, HDFC shareholders will get 42 shares of HDFC Bank for 25 shares held, based on the share-swap ratio announced in April last year. Capitalizing on the ratio, the trade effectively enables an investor to buy shares in the merged entity at a discount to HDFC Bank’s current price.

While the spread has reduced to 1% as of Monday from 5.6% a year ago, it can still make a difference for funds with large investments seeking to increase returns for their unit holders.

“There is lot of competition among fund managers, and any opportunity to boost performance is likely to be pounced on,” said Abhay Agarwal, founder of Piper Serica Advisors Pvt. But the window may be narrowing, as the gap is likely to evaporate as the merger nears completion, he said.

HDFC shares climbed as much as 2.3% on Tuesday, the most since early May, as Chairman Deepak Parekh said the securities will stop trading July 13. HDFC Bank’s shares also rose as much.

The latest available quarterly data show foreign investors trimmed exposure to both HDFC Bank and HDFC from the merger announcement through March. Such selling has helped keep the spread from narrowing too much, according to Abhilash Pagaria, head of alternative and quantitative research at Nuvama Wealth Management Ltd.

The flight of overseas funds may be in part due to concerns over the weighting global indexes will give the stock after the merger. HDFC Bank will also likely see outflows from some actively managed mutual funds in India that have to comply with regulations limiting single-stock exposure to 10% of a fund’s assets.

Overall, local funds will likely continue to look for the best ways to improve potential future returns on HDFC Bank.

“If you are a long-term investor, it is still very lucrative trade to do in the cash market,” Pagaria said. Speculative traders may initiate arbitrage positions in July futures contracts of both stocks until the record date is announced, he added.

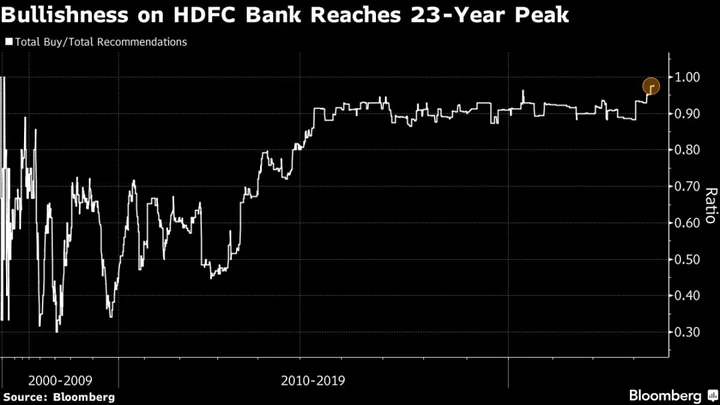

Analysts covering India’s largest lender, meanwhile, are turning bullish as the completion of the merger removes a major overhang and focus shifts to lender’s ability to capitalize on growth in a robust credit environment for the sector.

Buy recommendations for HDFC Bank are now around 98% of the total calls on the stock, the highest since October 2000, data compiled by Bloomberg show. The lender has seen the biggest improvement in analyst sentiment this year compared with major rivals such as ICICI Bank Ltd., State Bank of India Ltd., and Axis Bank Ltd.

--With assistance from Abhishek Vishnoi and Suvashree Ghosh.