Posco, one of the world’s top steelmakers, would need to consider moving some of its most energy-intensive manufacturing out of South Korea if it’s unable to switch to greener processes, according to an executive.

Steel producers globally are attempting to slash the climate impact of an industry that accounts for about 8% of energy sector emissions, and in Posco’s home nation that’s complicated by a fossil fuel-dominated power system that lacks renewables.

A switch to zero-emissions steelmaking will need about 3.7 million tons a year of green hydrogen — created using clean energy — by 2050, according to Kim Hee, a senior vice president responsible for Posco’s efforts to achieve carbon neutrality. That’s a factor that could prompt the producer to look overseas at nations including Australia, she said.

“Having our upstream processing in another region will be considered as our last resort as the decision poses several risks,” Kim said in an interview. “Still, the fact that we may put this idea on the table shows how desperate we are in delivering our climate commitment.”

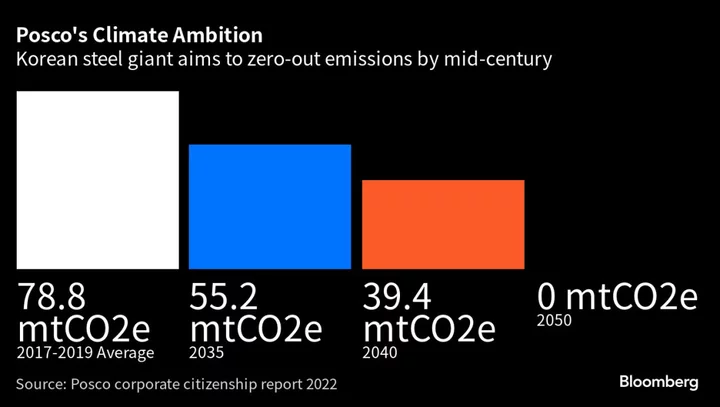

Posco has operations and subsidiaries in 16 other nations, though produces the majority of its steel in South Korea. The company is aiming to reduce emissions by 30% by 2035 and hit net zero by mid-century.

Read More: How Steel Could Become Green, and What It Would Take: QuickTake

Japan’s biggest steelmaker Nippon Steel Corp. flagged earlier this year that high domestic electricity costs mean it would examine sites in Australia and Brazil for a proposed green steel project with a potential cost of 100 billion yen ($674 million) or more.

Posco — South Korea’s largest corporate emitter — estimates it’ll cost around 40 trillion won ($30 billion) to achieve net zero and would involve development of nine hydrogen-fueled production facilities. The costs of a clean transition will also likely rise further, including as a result of high energy prices, Kim said in the Sept. 20 interview.

“Decarbonizing steel is extremely costly and challenging,” Kim said. “Without the support from the government and our community, Posco’s climate mission will be impossible to achieve.” Subsidies, tax breaks and government efforts to spur deployment of hydrogen would all assist the company’s task, she said.

Read More: Posco to Invest $92 Billion Through 2030 in Batteries, Hydrogen

The producer, the steel unit of Posco Holdings Inc., aims to commercialize its method of hydrogen-based steelmaking — which uses the gas in place of fossil fuels — by the end of the decade after demonstrating the technology at a pilot plant from 2026, according to Kim.

Under plans to phase out the use of traditional blast furnaces, Posco will also increase the use of electric arc technology and is reviewing potential further investments after adding a 600 billion won plant in Gwangyang.

Options for the supply of hot briquetted iron — used in electric arc furnaces — from regions including the Middle East are being studied, Kim said. Posco also aims to produce the material at a facility in Australia with billionaire Gina Rinehart’s Hancock Prospecting.