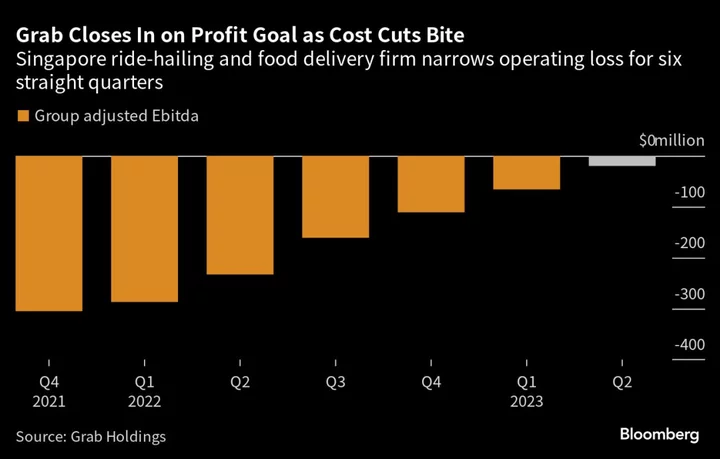

Grab Holdings Ltd. shares jumped 11% after the company brought forward its profitability target and posted a narrower quarterly loss, buoyed by extensive cost cuts at the Southeast Asian ride-hailing and food-delivery provider.

The stock had its biggest gain in three months in New York after Grab said on Wednesday it expects to break even in the third quarter, rather than the fourth quarter as previously projected. Second-quarter adjusted losses narrowed more than analysts had predicted, and sales topped estimates.

Grab has grown rapidly since its founding in 2012, but losses mounted as it spent on expansion and luring customers amid intense competition from rivals such as GoTo Group and Sea Ltd. A recent focus on cost curbs — including more than 1,000 job cuts in June — has brought the Singapore-based company on the brink of profitability for the first time.

The results are “a clean and solid beat especially on improving momentum in mobility and delivery,” analysts at Citigroup said in a note. The outlook reflects “effective cost control and clear execution direction.”

Grab said its adjusted full-year loss before interest, taxes, depreciation and amortization will be $30 million to $40 million, rather than the loss of $195 million to $235 million it forecast in May. Loss on that basis shrank to $20 million in the second quarter, versus analysts’ average estimate for a loss of $64.6 million.

Revenue rose 77% to $567 million, dispelling some fears that rising inflation and a gloomy economic outlook would damp customer spending.

Grab is among Southeast Asian internet giants that are treading a fine balance between spending on growth and focusing on profitability. Investors rewarded GoTo last week after it cut its 2023 loss projection, while punishing Sea after it reported disappointing revenue and outlined plans to increase investment in e-commerce.

While Grab leads Southeast Asia’s ride-hailing and delivery markets, it’s remained on the red as it spends on growth and competition from rivals such as Indonesia’s GoTo weighs on prices. Shares of Grab, which had been one of Southeast Asia’s hottest startups, have struggled since it went public via a merger with a US blank-check company less than two years ago.

Grab said in June it’s cutting more than 1,000 jobs in its biggest round of layoffs since the pandemic, in a sign of growing pressure from investors for the internet firm to slash expenses further. Rivals Sea and GoTo eliminated thousands of jobs last year.

Grab’s gross merchandise value, or the total value of goods and services it provides, grew 4% to $5.24 billion in the second quarter. While that’s down from double-digit rates in the past years, growth accelerated from 3% pace in the previous quarter.

Users of the company’s subscription program, GrabUnlimited, rose by 43% from a year earlier. Subscribers spent 3.8 times more on food orders than other users, accounting for almost a third of Grab’s deliveries GMV.

What Bloomberg Intelligence Says:

Grab pulling forward its breakeven goal to 3Q from 4Q, along with 2Q revenue and adjusted Ebitda that were 4% and 70% above consensus, underscores the potential of GrabUnlimited. These subscribers generate average spending 3x that of non-subscribers and could deliver a $50-$90 million boost to the 2023 bottom line, we believe.

-Nathan Naidu, analyst

Click here for research

Chief Executive Office Anthony Tan has said the job reductions weren’t a “shortcut to profitability.” He’s said the company was on track become profitable even without the cuts.