Alphabet Inc.’s Google may be a giant in the digital advertising market, but even the industry leader is worried about losing its edge.

“I would not say Google search ads are a must-have for any advertiser,” said Jerry Dischler, vice president for Google’s advertising products, in testimony Tuesday during the federal antitrust trial against the company. “We are losing share to other new entrants” including TikTok and Amazon.com Inc., he said.

The Justice Department alleges that Google has illegally maintained a monopoly over online search by paying billions of dollars to web browsers and smartphone manufacturers to ensure it’s the preselected option for users accessing the web. As part of those deals, Google pays Apple Inc., Samsung Electronics Co. and others a share of the revenue it earns from search advertising.

About two-thirds of Google’s total revenue comes from search ads, Dischler said, and in 2020 that amounted to more than $100 billion. Every year since 2012, the company’s search ad revenue growth has been in the “high teens,” according to documents shown by the Justice Department. The exact numbers were redacted.

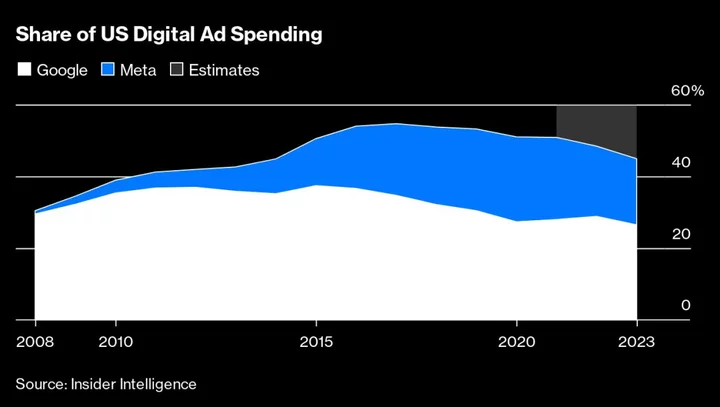

For more than five years, Google and Meta Platforms Inc. have dominated the digital advertising market, collecting more than half of all online ad dollars. But recent shifts in the landscape, including changes in Apple’s privacy policy that crippled the effectiveness of their ads on iPhones, have opened an opportunity for major competitors like Amazon.

Dischler said Google has roughly 5 million advertisers, compared with about 10 million who advertise on Meta. Retail advertisements account for about 35% of Google’s search ads, he said, its biggest category of advertising.

In response to a question from US District Judge Amit Mehta, who is overseeing the government’s case, Dischler said that some consumer goods makers have threatened to remove all of their advertising spending from Google and move it to Amazon. Today, Amazon is bigger than Google in retail advertising, he said, and is growing at twice the rate.

Amazon is “able to get better data than we are on the effectiveness of their advertising,” Dischler said. “That has caused budgets to shift.”

Read more: Google and Meta Are Losing Their Grip on the Digital Ad Market

Ad Tunings

Dischler said Google frequently makes changes to the auctions it uses to sell search ads — the text and shopping promotions that appear at the top of a results page in response to user queries. Those changes can involve increasing the cost of ads or minimum spending on an ad, known as the reserve pricing, he said. Even when those “tunings” impact ad prices, Google typically doesn’t tell advertisers, Dischler testified.

“We tend not to tell advertisers about pricing changes,” he said.

Google has tweaked its advertising auctions to ensure it meets revenue targets, sometimes increasing ad prices by as much as 5%, Dischler said.

In one May 2019 email, Dischler and his team discussed how they were “shaking the cushions” to find potential changes to the ad auctions that would ensure Google met the revenue targets that Chief Financial Officer Ruth Porat had conveyed to Wall Street for the quarter.

If we don’t meet “quota for the second quarter in a row and we miss the street’s expectations again, which is not what Ruth signaled to the street, so we will get punished pretty bad in the market,” Dischler wrote.

“I care more about revenue than the average person but think we can all agree that for our teams trying to live in high cost areas another $100,000 in stock price loss will not be great for morale, not to mention the huge impact on our sales team,” he said.

In court on Monday, Dischler said his goal was “to get creative so we could meet our quota.”

‘Honest Results’

On cross-examination Tuesday by Google’s lawyers, Dischler said the search giant has an “honest results” policy and the search team responsible for non-paid search results, known as organic results, can ignore suggestions by the ads team.

“Financial compensation shouldn’t impact the quality of the search results,” he said, calling it a “church and state” separation between the two teams. “Revenue is motivator, not a decider.”

In response to questions by DOJ lawyer David Dahlquist, Dischler acknowledged that some of the auction changes led to 5% increases for the typical advertiser. He also said that it was “possible” that some changes led to price increases of as much as 10% for some queries.

But Dischler said Monday he believes most advertisers would move to rivals like Meta or ByteDance Ltd.’s TikTok if Google tried to increase prices by 15%.

“It would be a dangerous thing to do,” he said.

Amazon on Top

Dischler acknowledged, however, that he didn’t have any reason to believe that even with a 15% increase Google wouldn’t keep enough advertisers so that the company’s revenue still rose.

One change that increased Google’s revenue, known as RGSP, switched the auction so the runner-up was given the top advertiser slot and the actual winner the second spot, according to Dischler. Oftentimes major advertisers like Amazon or Booking Holdings Inc. win any ad auctions where they bid and take the top slot, Dischler said.

With RGSP, “we flip them,” Dischler said. “Otherwise, Amazon always shows up on top.”

Dischler said he didn’t know if the change led advertisers to place higher bids, but it increased Google’s revenue.

A Google spokesman at the trial declined to comment on Dischler’s testimony.