Goldman Sachs Group Inc. expects inflation in Australia and New Zealand to ease to “a bit below” 3% by late-2024, within the targets of both central banks and paving the way for reductions in interest rates.

“An easing in inflation of this magnitude would normally require a sharp deterioration in the labor market,” economists led by Andrew Boak wrote in Goldman’s 2024 Outlook report published Tuesday. “We continue to expect that Australia and New Zealand will achieve a soft landing in 2024.”

The cooling in prices will be driven by global goods inflation, softening labor demand and wage pressures that will help ease sticky services prices, Goldman said. That will open the door for both central banks to begin “a gradual easing” in monetary policy from late next year.

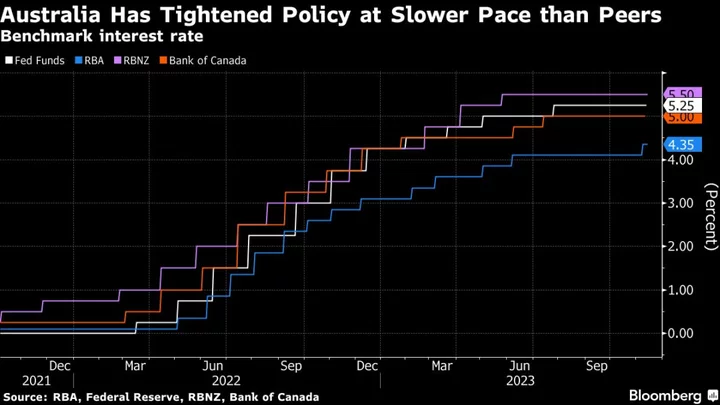

Goldman’s take sharply contrasts with forecasts from Australia’s central bank which raised interest rates just last week to a 12-year-high of 4.35%, predicting CPI will overshoot its 2-3% target until mid-2025. On Monday, Reserve Bank of Australia Acting Assistant Governor Marion Kohler said the next stage of bringing inflation back to target is likely to be more “drawn out.”

Goldman does see upside risks to inflation for Australia driven by a combination of stronger-than-expected wages growth, ongoing weak productivity, rising energy costs and persistently strong housing prices.

“Our working assumption is that the RBA remains a ‘reluctant hiker’ and their reaction function does not change materially in the near term,” Goldman said. “However, we caution that several important decisions on RBA board appointments and implementation of the RBA review are imminent,”

New Zealand’s central bank has hiked at a much more rapid pace than the RBA, taking its official cash rate to 5.5%.

Even so, the downside risks to New Zealand’s economic growth have eased, Goldman said, though recent inflation and labor force reports “have strengthened our conviction that the Reserve Bank of New Zealand will remain on hold well into 2024.”

Based on its latest forecasts published in August, the RBNZ sees inflation returning to its 1-3% target in the third quarter of 2024.

There are risks to the RBNZ’s reaction function too, Goldman said, given an election pledge by the National Party, which will lead the next government, to remove the maximum sustainable employment component of the RBNZ’s existing dual mandate.

“The balance of risks to our RBA/RBNZ base case is skewed to higher rates in the near term,” Goldman said. “Consistent with our global economic team’s approach, we have also revised higher our longer run RBA/RBNZ rate forecasts by +50-basis-points to 3.50%.”