Global stock managers are bracing for pain as China’s dramatic slowdown undermines the prospects for companies elsewhere that rely on the world’s second-largest economy.

Once the most promising bet of the year, investments linked to China have turned into a bane as its property market slump risks spiraling into a systemic crisis. While the selloff so far has been concentrated in Chinese shares, pressure is rising for stocks in Europe, the US and other parts of Asia, whose businesses are swayed by demand in China.

Caterpillar Inc. and Dupont de Nemours Inc. are among a long list of firms that have sounded the alarm in their latest earnings releases. With China’s growth forecast getting slashed, investors are seeking to de-risk their portfolios. An MSCI index that tracks global companies with the biggest exposure to China has retreated about 10% this month, double the decline in the broader gauge of world stocks, while Bank of America Corp. strategists see US stocks dropping another 4% as the woes grow.

“Frankly, the entire world is inextricably linked to China. Big global firms either sell to China or source from China,” said Jason Hsu, chief investment officer at Rayliant Global Advisors. “These firms will have to meaningfully revise downward their revenue from China for the next 12 months.”

Confidence among investors, businesses and consumers over China’s economic outlook is rapidly dwindling following a flurry of negative news headlines this week — from dismal economic data to shadow banking giant Zhongzhi Enterprise Group Co halting payments to thousands of customers, and embattled property group Country Garden Holdings Co. edging closer to a public bond default.

The mounting worries have sent equity benchmarks in Hong Kong and China to their lowest levels since November, with the Hang Seng Index entering a bear market on Friday. And with the country’s dominant status in the global supply chain, the concerns have also started to hit investor sentiment in Europe and the US, with stock markets in both regions experiencing their biggest pullback since March.

Rajeev De Mello, a Geneva-based global macro portfolio manager at Gama Asset Management SA, said “many asset classes will suffer” unless Beijing unleashes more supportive policies, adding that he has cut exposure to European equities, commodities, gold and emerging currencies.

Here are some global sectors and companies that are vulnerable to the slump in China:

Miners

Miners have borne the brunt of the growing risks from China as the country is a big consumer of global iron ore, a key product for large mining firms. With a decline of 19%, the Stoxx 600 Basic Resources Index is the worst performer in Europe this year. Large-cap miners Anglo American Plc, Glencore Plc and Rio Tinto Plc have slumped between 20% and 40%.

Rio Tinto and Australian giant BHP Group Ltd. derive 50% to 60% of their revenues from China, while Glencore and Anglo American have an over 20% exposure, according to data compiled by Bloomberg.

“A weak China economy could lead to weak demand on the margin for certain products and commodities which are imported,” said Vivian Lin Thurston, a portfolio manager for William Blair Investment in Chigago. “We are watching any potential meaningful and concrete stimulus measure to come through in China.”

Luxury goods

Luxury goods firms such as Louis Vuitton bags-maker LVMH, Gucci-owner Kering SA and Hermes International are particularly vulnerable to any wobbles in Chinese demand as the country accounts for between 17% and 20% of their annual revenues, according to data from Goldman Sachs Group Inc.

Stocks in the sector had soared earlier this year as its high-end customers were perceived to be less affected by sticky inflation. But the group of LVMH, Kering, Hermes, Richemont, Swatch Group and Moncler SpA has lost a combined $86 billion in market capitalization this month through Friday as China growth risks intensified.

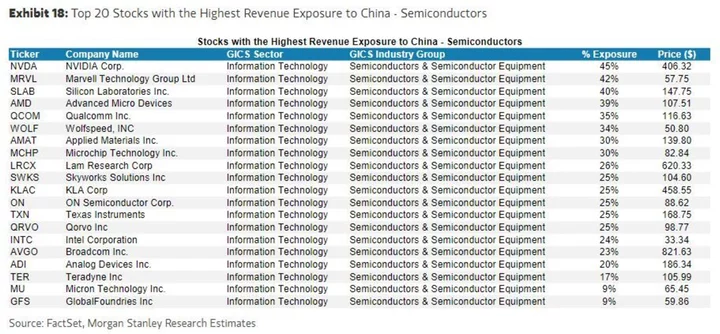

Semiconductors

US chipmakers such as Nvidia Corp. and Qualcomm Inc. generate a large chunk of their revenue from China, according to data compiled by Morgan Stanley. The sector has taken a hit from an escalation in the Sino-US tech war this year, with export controls exacerbating supply chain woes given that much of the world’s electronics and component systems come through Chinese factories.

While shares have still been buoyed by a frenzy in generative artificial intelligence this year, the optimism can be offset by a slowdown in global smartphone shipments, which is dragged by China’s weak consumer spending.

Industrials, Machinery

Japanese factory automation and machinery firms have had a poor earnings season, largely due to weak capital expenditure in China. Factory automation equipment manufacturer Fanuc Corp. cut its full-year operating income guidance citing weaker-than-expected demand from China.

Morgan Stanley analysts this week downgraded Japanese equity sectors that are most exposed to China’s slowdown, revising machinery to underweight and electrical appliances to equal weight.

“Investors might become wary of allocating funds to China due to concerns about the economic downturn and reduced potential returns,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore. “China’s recession-like conditions can have far-reaching consequences for its monetary policy, trading partners, and investor sentiment.”

--With assistance from Sagarika Jaisinghani, Michael Msika, Winnie Hsu, Abhishek Vishnoi and Yiqin Shen.