Almost nobody wants to miss out on the brisk rally in US tech.

That’s the broad consensus from Bank of America Corp.’s latest global survey of fund managers, which showed investors are “exclusively long” tech stocks amid the buzz around artificial intelligence. Long Big Tech was the most crowded trade, according to 55% of the participants, the strongest conviction since 2020.

Still, fund managers remain broadly underweight on stocks as sentiment — measured by cash levels, economic growth expectations and asset allocation — remains “stubbornly low,” BofA strategist Michael Hartnett wrote in a note. Investors cut equity allocation to a five-month low.

The frenzy around AI and bets of a pause in central-bank interest-rate hikes helped lift the S&P 500 into a bull market last week. Fresh figures Tuesday showed US inflation slowed in May, supporting the case for Federal Reserve officials to pause their tightening campaign this week.

Caution however prevailed in the survey, which showed that 59% of participants don’t think the Fed is done raising rates yet. That’s a sharp reversal from the previous month, when 61% indicated the central bank had delivered its last hike.

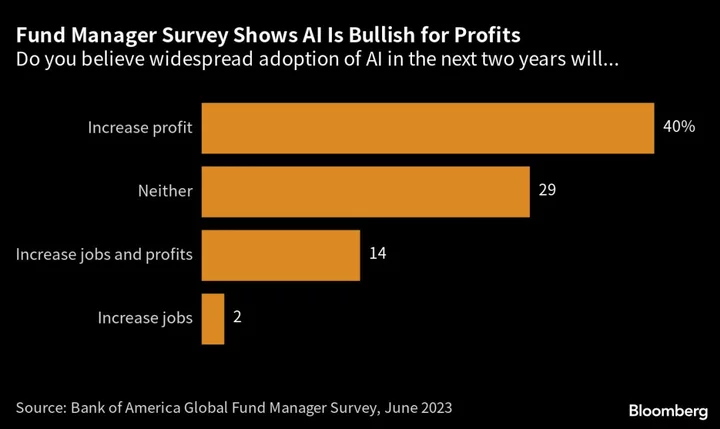

Participants are optimistic about the impact of AI over the next two years, with 40% expecting it to drive corporate profits higher, Hartnett said.

Other highlights from the survey, which was conducted from June 2 to 8 and canvassed 247 participants with $708 billion in assets under management:

- Growth expectations for China fall back to levels seen in November 2022

- Profit expectations turn less pessimistic; investors now expect global EPS growth of -0.6% over the next 18 months

- Average cash allocation declines to 5.1% in June from 5.6% in May; remain overweight bonds

- Net 19% expect value to outperform growth, while 37% think large caps will outperform small caps

--With assistance from Michael Msika.

(Updates with US inflation data in fourth paragraph)