AESC Group is targeting a valuation of about $10 billion in its latest funding round, according to people familiar with the matter, as the Asian maker of batteries used in electric vehicles seeks to boost growth.

AESC, which is controlled by Chinese clean energy firm Envision Group, is considering raising about $1.5 billion from private investors in a series C round, the people said, asking not to be identified because the information isn’t public.

Considerations are preliminary and details such as the fundraising size and valuation could still change, the people said. Representatives for AESC and Envision declined to comment.

The Japan-based company has been working with advisers on the series C round and is talking to anchor investors including global automakers, Bloomberg News reported last month. The new round would serve as a stepping stone to an initial public offering in the US, people familiar with the matter have said.

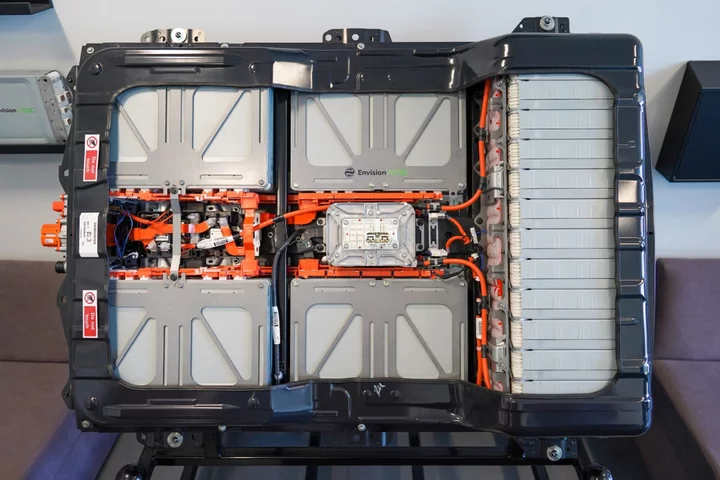

AESC develops and makes high-performance batteries for electric vehicles and energy storage systems, according to its website. The company counts major production facilities in countries such as the US, the UK, France, Spain, China and Japan. Its clients include some of the world’s largest carmakers.

AESC was originally the electric battery operations and production facilities of Japanese carmaker Nissan Motor Co. In 2019, Shanghai-based Envision acquired a controlling stake in the battery maker for an undisclosed amount. Nissan retained a minority stake.

Envision raised more than $1 billion from Sequoia Capital, Singaporean sovereign wealth fund GIC Pte and Primavera Capital in 2021 to help accelerate the pace of energy transition via strategic partnerships.

--With assistance from Linda Lew.

Author: Elffie Chew, Manuel Baigorri and Dong Cao