Germany will suspend a constitutional limit on net new borrowing for a fourth consecutive year after Chancellor Olaf Scholz’s government was forced into a radical budget overhaul by a ruling last week from the nation’s top court.

Finance Minister Christian Lindner will announce the suspension of the limit, known as the “debt brake,” for this year at 4 p.m. in Berlin, according to people familiar with the decision, who asked not to be identified discussing confidential information.

Read More: German Yields Touch Session Highs on Debt Brake Suspension News

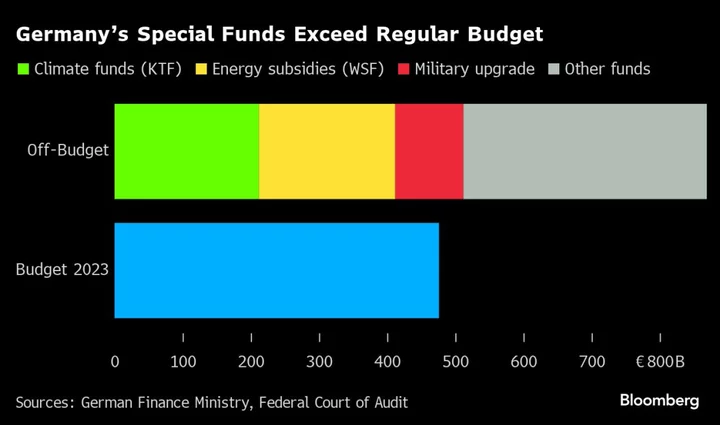

The landmark judgment by the Constitutional Court in Karlsruhe called into question hundreds of billions of euros of financing in special funds — some of them decades old — that are not part of the regular federal budget.

Scholz’s administration earmarked cash from the various pots for initiatives including greening manufacturing, expanding renewables and charging infrastructure and subsidies for battery and semiconductor facilities. One was also being tapped to help ease the burden from high energy prices on households and consumers.

Using the special funds initially enabled Lindner to fulfill a pledge to reinstate the debt brake for the regular budget this year, while still directing cash to support the revamp of Germany’s manufacturing base and help reduce harmful emissions.

The chairman of the fiscally hawkish Free Democratic party now has to suspend the borrowing limit again because he has to retroactively account for €37 billion ($40.3 billion) of new debt in a revised 2023 federal budget, people familiar with the matter told Bloomberg this week.

Faced with the potential for more borrowing, German debt extended declines following the news, pushing 10-year yields as much as six basis points higher to 2.62%. The premium on swaps over corresponding bonds — a key measure of supply risk — erased gains to leave the spread close to the lowest since February last year at 52 basis points.

The borrowing restrictions are baked into Germany’s constitution but can be temporarily set aside in the case of natural disasters or emergencies beyond the control of the government.

They were suspended for three years through 2022 to address the fallout from the Covid-19 pandemic and the energy crisis triggered by Russia’s invasion of Ukraine.

What Bloomberg Economics Says...

“The country’s fiscal policy outlook has become much more uncertain. A raft of infrastructure and environmental projects might not receive funding now. This could reduce GDP growth by 0.5 ppt next year, jeopardizing the gradual recovery after the downturn in 2023, and adding considerable downside risk to our 2024 forecast.”

—Martin Ademmer, economist. Click here for full GERMANY INSIGHT

Underlining the drama of the situation, the Finance Ministry on Monday froze virtually all new spending authorizations for this year as it assesses the broader and longer-term impact for the of the court ruling, according to a letter sent to government ministries seen by Bloomberg.

So far, market reaction to the court ruling has been limited, though over the longer term it could prove supportive given the prospect of lower issuance next year.

Under the debt brake rules, structural net borrowing — adjusted to take cyclical factors into account — is limited to 0.35% of gross domestic product. An increase in net borrowing is permitted during an economic downturn, but there is less leeway for additional debt during an upswing.

--With assistance from James Hirai.

(Updates with additional details starting in third paragraph)